Global X Copper Miners ETF (COPX)

36.20

+0.00 (0.00%)

NYSE · Last Trade: Apr 17th, 6:59 AM EDT

Detailed Quote

| Previous Close | 36.20 |

|---|---|

| Open | - |

| Day's Range | N/A - N/A |

| 52 Week Range | 30.77 - 52.90 |

| Volume | 515 |

| Market Cap | 22.25M |

| Dividend & Yield | 0.3180 (0.88%) |

| 1 Month Average Volume | 1,585,017 |

Chart

News & Press Releases

In this video, Ira Epstein reviews the day's trading in the gold and other relevant metal markets.

Via Talk Markets · April 17, 2025

In this video, Ira Epstein reviews the day's trading in the gold and other relevant metal markets.

Via Talk Markets · April 16, 2025

As inflation was finally coming under some level of control, paired with a strong economy and robust labor market, many commodities remained bullish.

Via Talk Markets · April 15, 2025

Oil prices rose yesterday despite OPEC making some small downward revisions to demand growth estimates.

Via Talk Markets · April 14, 2025

Given the situation in the USD Index, stocks, and how strongly silver reacted to the first wave of selling, it seems that much bigger declines are just around the corner.

Via Talk Markets · April 14, 2025

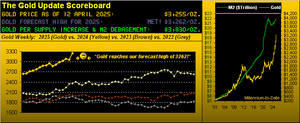

Given price’s present momentum, 3400 from here (+4.5%) seems a mere stone’s throw, barring it suddenly going all wrong for gold.

Via Talk Markets · April 13, 2025

In this video, Ira Epstein reviews the day's trading in various SPDR-ETF markets for the trading day that ended, Thursday, April 10

Via Talk Markets · April 11, 2025

In this video, Ira Epstein reviews the day's trading in the gold and other relevant metal markets.

Via Talk Markets · April 10, 2025

Trump surprised markets with a 90-day pause in reciprocal tariffs for most trading partners. This provided a boost to risk assets, including commodities. However, there’s still plenty of uncertainty as the US again increased tariffs on China.

Via Talk Markets · April 10, 2025

Mining sector hit hard by new tariffs, but analysts expect a V-shaped recovery with potential for significant upside. Top stock and ETF picks.

Via Benzinga · April 9, 2025

In this video, Ira Epstein reviews the day's trading in the gold and other relevant metal markets.

Via Talk Markets · April 9, 2025

Stocks are in an unambiguous bear trend right now.

Via Talk Markets · April 8, 2025

Via Benzinga · April 8, 2025

Liberation Day isn’t just another headline - it’s a turning point for the global economy.

Via Talk Markets · April 4, 2025

Trump tariff sell-off continues.

Via Talk Markets · April 4, 2025

In this video, Ira Epstein reviews the day's trading in the gold and other relevant metal markets.

Via Talk Markets · April 3, 2025

Silver is up more than gold – outperforming it on an immediate-term basis. At the same time, miners are down. This is a classic short-term sell signal.

Via Talk Markets · April 2, 2025

In this video, Ira Epstein reviews the day's trading in the gold and other relevant metal markets.

Via Talk Markets · April 2, 2025

The first quarter was an incredibly tumultuous period for markets, with the S&P 500 posting its biggest quarterly decline since 2022.

Via Talk Markets · April 1, 2025

In this video, Ira Epstein reviews the day's trading in the gold and other relevant metal markets.

Via Talk Markets · April 1, 2025

While gold captures the spotlight, copper is quietly stealing the show.

Via Talk Markets · March 31, 2025

A significant drop in Asian stock markets led to a decline in copper prices, despite rising long-term demand and tightening supplies.

Via Talk Markets · March 31, 2025

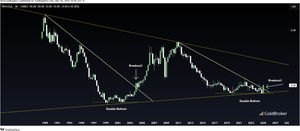

A couple of Copper charts that suggest the commodity boom (think

Via Talk Markets · March 31, 2025

Copper ETFs hit record highs as U.S. considers imposing tariffs on imports. Prices spike, inflows surge and miners benefit. Global supply concerns.

Via Benzinga · March 27, 2025

A standard business cycle in the US economy takes around four years to play out, from weakness to strength to weakness.

Via Talk Markets · March 27, 2025