Bloom Energy Corporation Class A Common Stock (BE)

149.50

+10.33 (7.42%)

NYSE · Last Trade: Jan 19th, 5:13 PM EST

Via Benzinga · January 19, 2026

Bloom has skyrocketed over 550% over the last year. Can it repeat this extraordinary performance in 2026?

Via The Motley Fool · January 18, 2026

Explore how each ETF’s approach to diversification and sector focus shapes the balance between risk and opportunity for growth investors.

Via The Motley Fool · January 17, 2026

Brookfield Corporation is my highest conviction investment.

Via The Motley Fool · January 17, 2026

BE Stock Jumps After AEP Unit Signs $2.65B Deal For Fuel Cells — Analysts Call It A ‘Meaningful Positive’ For Bloom Energystocktwits.com

Via Stocktwits · January 8, 2026

Let’s dig into the relative performance of Blink Charging (NASDAQ:BLNK) and its peers as we unravel the now-completed Q3 renewable energy earnings season.

Via StockStory · January 15, 2026

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at EVgo (NASDAQ:EVGO) and the best and worst performers in the renewable energy industry.

Via StockStory · January 15, 2026

Shares of electricity generation and hydrogen production company Bloom Energy (NYSE:BE) jumped 6.3% in the afternoon session after it continued a multi-day rally sparked by a landmark $2.65 billion agreement with American Electric Power (AEP) for its solid-oxide fuel cells.

Via StockStory · January 15, 2026

Industrials businesses quietly power the physical things we depend on, from cars and homes to e-commerce infrastructure. They are also bound to benefit from a friendlier regulatory environment with the Trump administration,

and this excitement has led to a six-month gain of 19.9% for the sector - higher than the S&P 500’s 11.5% return.

Via StockStory · January 14, 2026

Wrapping up Q3 earnings, we look at the numbers and key takeaways for the renewable energy stocks, including Nextpower (NASDAQ:NXT) and its peers.

Via StockStory · January 14, 2026

A deal and a partnership position BE as a direct beneficiary of data-center power demand, but a rally and stretched valuation prices in a lot of the optimism.

Via Barchart.com · January 14, 2026

Kraft Heinz is set to report its fourth-quarter earnings soon, and analysts are anticipating a double-digit profit dip.

Via Barchart.com · January 14, 2026

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how renewable energy stocks fared in Q3, starting with EnerSys (NYSE:ENS).

Via StockStory · January 12, 2026

Defense, AI power demand and deal-driven catalysts powered last week's top large-cap winners, led by sharp surges in RGC, RVMD and a cluster of defense and data-center energy plays.

Via Benzinga · January 11, 2026

It's all about AI and data centers, according to some market professionals tracking the company.

Via The Motley Fool · January 9, 2026

Bloom Energy has a solution to the problem of powering data centers, and it's ready now.

Via The Motley Fool · January 9, 2026

Small caps led the way. Nvidia and AMD fell despite unveiling new AI chips at CES.

Via Investor's Business Daily · January 9, 2026

Let’s dig into the relative performance of Enphase (NASDAQ:ENPH) and its peers as we unravel the now-completed Q3 renewable energy earnings season.

Via StockStory · January 8, 2026

As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the renewable energy industry, including Plug Power (NASDAQ:PLUG) and its peers.

Via StockStory · January 8, 2026

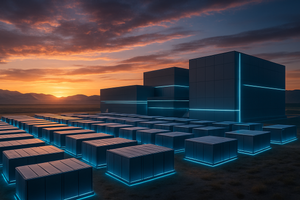

In a landmark decision that bridges the gap between massive AI compute demands and sustainable energy solutions, Bloom Energy (NYSE: BE) shares skyrocketed by more than 18% in early trading on January 8, 2026. The surge follows the final regulatory approval for a colossal 1.8-gigawatt (GW) AI data center

Via MarketMinute · January 8, 2026

Bloom Energy shares are up Thursday afternoon following a recent credit agreement that bolsters investor confidence.

Via Benzinga · January 8, 2026

One customer sees fuel cells as a smart way to meet the high power demands for AI computing.

Via The Motley Fool · January 8, 2026

Bloom Energy's stock price nearly quadrupled in 2025. Could the run keep going in 2026?

Via The Motley Fool · January 8, 2026

Shares of Bloom Energy (NYSE: BE) surged more than 18% in early trading today, January 8, 2026, following the announcement of a definitive agreement to provide nearly a gigawatt of power to a monumental AI data center campus in Cheyenne, Wyoming. The deal, which marks one of the largest private

Via MarketMinute · January 8, 2026

Bloom Energy roared above a buy point in Thursday's stock market action on a key data center project approval.

Via Investor's Business Daily · January 8, 2026