Kratos Defense & Security Solutions, Inc. - Common Stock (KTOS)

87.00

+1.46 (1.71%)

NASDAQ · Last Trade: Mar 6th, 10:51 PM EST

Varonis Systems delivers data security and analytics solutions to enterprises worldwide, serving IT, security, and business teams.

Via The Motley Fool · March 6, 2026

Via MarketBeat · March 6, 2026

Kratos stock has potential -- but not near-term potential.

Via The Motley Fool · March 6, 2026

What Happened? A number of stocks fell in the afternoon session after geopolitical tensions in the Middle East escalated, sent oil prices soaring and reignit...

Via StockStory · March 5, 2026

Kratos Defense & Security (NASDAQ:KTOS) Beats Q4 Estimates but Stock Falls on Guidance and Capex Planschartmill.com

Via Chartmill · February 23, 2026

Mid-cap stocks often strike the right balance between having proven business models and market opportunities that can support $100 billion corporations. Howe...

Via StockStory · March 4, 2026

ARLINGTON, VA — Shares of AeroVironment (NASDAQ:AVAV) are staging a dramatic comeback this week after a harrowing 17% single-day plunge on March 2, 2026, sent shockwaves through the defense sector. The sell-off, which wiped out billions in market capitalization in a matter of hours, has been met with a wave

Via MarketMinute · March 4, 2026

Kratos Defense & Security Solutions insiders are selling, putting downward pressure on the market in distribution; institutions sell, and analysts limit upside.

Via MarketBeat · March 2, 2026

Shares of aerospace and defense company Kratos (NASDAQ:KTOS)

jumped 3.5% in the afternoon session after geopolitical tensions in the Middle East spurred a rally across the defense sector.

Via StockStory · March 2, 2026

Shares of Kratos Defense & Security Solutions, Inc. (NASDAQ: KTOS) are rising Monday following the joint U.S.-Israel attack on Iran over the weekend.

Via Benzinga · March 2, 2026

Kratos just raised cash and diluted its shareholders. Will Red Cat do likewise?

Via The Motley Fool · February 27, 2026

Investors are upset, but Kratos is selling stock at the exact right time -- to never need to sell shares again.

Via The Motley Fool · February 27, 2026

Data from Stocktwits showed that retail sentiment on SPY has moved to ‘bullish’, while it remained ‘bearish’ on QQQ.

Via Stocktwits · February 27, 2026

Kratos Defense & Security Solutions Inc (NASDAQ:KTOS) shares are trading lower in after-hours Thursday after the company announced a proposed offering.

Via Benzinga · February 26, 2026

Via MarketBeat · February 25, 2026

Check out the companies making headlines yesterday:

Via StockStory · February 25, 2026

Shares of aerospace and defense company Kratos (NASDAQ:KTOS)

fell 5.7% in the morning session after the company's weak first-quarter revenue guidance overshadowed its strong fourth-quarter results.

Via StockStory · February 24, 2026

At 730 times earnings, it's hard to call Kratos stock a "buy."

Via The Motley Fool · February 24, 2026

Kratos (KTOS) Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 23, 2026

Kratos’ earnings call provided insights into the contracts it has received for 2026, noting it is slated for margin expansion this year.

Via Stocktwits · February 23, 2026

Aerospace and defense company Kratos (NASDAQ:KTOS) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 21.9% year on year to $345.1 million. Revenue guidance for the full year exceeded analysts’ estimates, but next quarter’s guidance of $340 million was less impressive, coming in 0.7% below expectations. Its non-GAAP profit of $0.18 per share was 22.1% above analysts’ consensus estimates.

Via StockStory · February 23, 2026

Kratos Defense & Security Solutions Inc (NASDAQ:KTOS) reports financial results for the fourth quarter after the market close on Monday.

Via Benzinga · February 23, 2026

Varonis Systems provides data security and analytics software to global enterprises, helping organizations manage access and compliance.

Via The Motley Fool · February 23, 2026

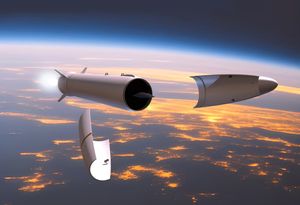

Kratos stock has been in the spotlight for its selection to participate in phase 1 of the Drone Dominance Program, and investors are looking forward to updates on the same during earnings.

Via Stocktwits · February 22, 2026

Aerospace and defense company Kratos (NASDAQ:KTOS)

will be reporting earnings this Monday after market hours. Here’s what investors should know.

Via StockStory · February 21, 2026