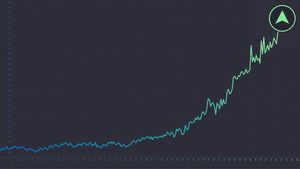

Interactive Brokers Group, Inc. - Class A Common Stock (IBKR)

67.49

+0.79 (1.18%)

NASDAQ · Last Trade: Mar 9th, 8:18 PM EDT

Wall Street’s long-standing era of "unbridled optimism" came to a grinding halt this week as the CBOE Volatility Index (VIX) experienced a jarring 9.9% spike, landing at 23.57 and signaling a decisive shift toward a "risk-off" market environment. This sudden surge in the market's primary "fear gauge"

Via MarketMinute · March 9, 2026

The company combines a hyper-efficient automated platform with massive account growth to justify the stock's premium valuation.

Via The Motley Fool · March 7, 2026

Many U.S. companies are cash rich at the moment, something investors should look for.

Via The Motley Fool · March 7, 2026

Interactive Brokers Group Inc. (NASDAQ:IBKR) Shows High-Grade Technical Breakout Setupchartmill.com

Via Chartmill · February 27, 2026

Prediction markets are grabbing headlines, but the two biggest names in it, Polymarket and Kalshi, aren't publicly traded.

Via The Motley Fool · March 7, 2026

Via MarketBeat · March 6, 2026

Polymarket is grabbing headlines, but Palantir is demonstrating durable growth.

Via The Motley Fool · March 5, 2026

Investors were reacting to its latest monthly operational update.

Via The Motley Fool · March 2, 2026

Peabody Energy is a global coal producer supplying major utility and industrial clients with thermal and metallurgical coal products.

Via The Motley Fool · March 2, 2026

GPGI manufactures metal payment cards and advanced industrial equipment for financial and manufacturing clients across multiple sectors.

Via The Motley Fool · March 2, 2026

The real test isn't whether Interactive Brokers has an edge today. It's whether that edge strengthens as the brokerage industry evolves.

Via The Motley Fool · February 28, 2026

By scaling efficiently, strengthening client trust, and converting growth into clean profits, Interactive Brokers proved that disciplined execution can be more potent than flashy innovation.

Via The Motley Fool · February 28, 2026

A number of stocks fell in the afternoon session after the release of a stronger-than-anticipated Producer Price Index (PPI) report showed wholesale inflation rose more than expected in January.

Via StockStory · February 27, 2026

Via Benzinga · February 27, 2026

As of February 26, 2026, the digital asset landscape is witnessing a profound maturation, and at the center of this evolution sits Coinbase Global, Inc. (NASDAQ: COIN). Recently, the company captured the attention of Wall Street and retail investors alike with a sharp 13% climb in its stock price following its Q4 2025 earnings report. [...]

Via Finterra · February 26, 2026

Interactive Brokers builds its revenue engine for the long run, but 2026 may test its short-term momentum.

Via The Motley Fool · February 24, 2026

Frontier Group Holdings operates a streamlined fleet serving around 120 airports, focusing on low-fare air travel across the Americas.

Via The Motley Fool · February 24, 2026

Upwork connects businesses with global freelance talent through its digital marketplace and value-added services platform.

Via The Motley Fool · February 24, 2026

Via Benzinga · February 23, 2026

Caesars is known for packed casino floors and bright Las Vegas lights, but the company is also working to strengthen its balance sheet and improve digital profitability. As debt levels decline and online betting operations mature, investors are watching whether the next phase can unlock more stable growth.

Via The Motley Fool · February 21, 2026

Interactive Brokers Group and CME Group turn the world's unpredictability into higher profits.

Via The Motley Fool · February 20, 2026

The retail trading landscape faced a sharp correction last week as shares of Robinhood Markets, Inc. (NASDAQ:HOOD) plummeted 11.3%, closing at approximately $76.87 following the release of its fourth-quarter and full-year 2025 financial results. Despite delivering a "bottom-line" surprise with earnings that outpaced Wall Street forecasts, the

Via MarketMinute · February 19, 2026

Yesterday, with Interactive Brokers (IBKR) trading at $74.90, the March put option with a strike price of $70 was trading around $1.55. Traders selling this put would receive $155 in option premium.

Via Barchart.com · February 19, 2026

As Bitcoin (BTC) hovers around the $83,200 mark this February, the digital asset market is entering a phase of uneasy stabilization. Following a blistering climb to a cycle peak of $126,000 in October 2025, the current "consolidation floor" represents a 34% retracement that has fundamentally altered the trading

Via MarketMinute · February 18, 2026