Latest News

Trump’s resharing of Walmart store closures draws flak from the California Governor.

Via Stocktwits · January 29, 2026

META stock appears attractive as a long-term holding also because the titan issued solid guidance for its current quarter. In Q1, it sees sales coming in at $55 billion, well above the Street at $51.41 billion.

Via Talk Markets · January 29, 2026

Silver prices are blasting higher as demand far outpaces supply, and First Majestic is one company that could ride this wave higher.

Via The Motley Fool · January 29, 2026

Healthcare Triangle shares jumped over 34% after hours following the completion of a $50 million acquisition of two Spanish companies.

Via Benzinga · January 29, 2026

Hut 8 Hits Record High After Big Tech AI Spend Lifts Crypto Minersstocktwits.com

Via Stocktwits · January 29, 2026

Recent reports also note that SoftBank is eyeing a further $30 billion investment.

Via Stocktwits · January 29, 2026

Economist Peter Schiff issued a stark warning regarding the state of the current U.S. equity markets, following a record rally in gold spot prices.

Via Benzinga · January 29, 2026

Advanced Micro Devices has numerous catalysts in 2026.

Via The Motley Fool · January 29, 2026

Is China about to allow its tech companies to purchase Nvidia AI chips?

Via The Motley Fool · January 29, 2026

Elon Musk-led Tesla revealed 1.1 million active FSD subscriptions during its earnings call amid $99/month fee transition.

Via Benzinga · January 29, 2026

BigBear.ai's stock is off to a strong start in 2026.

Via The Motley Fool · January 29, 2026

While Keurig Dr Pepper has lagged behind the broader market over the past year, Wall Street analysts maintain a moderately optimistic outlook on the stock’s prospects.

Via Barchart.com · January 29, 2026

A responsible-gambling push in Ontario and aggressive 2026 growth plans keep momentum roaring.

Via Stocktwits · January 29, 2026

Columbia Banking System’s fourth quarter saw a positive market response, as results outpaced Wall Street’s expectations. Management attributed this performance primarily to the successful integration of the Pacific Premier acquisition, which expanded the bank’s presence in key Western markets and contributed significantly to earnings. CEO Clint Stein highlighted that operational enhancements and a disciplined focus on profitability, including balance sheet optimization and ongoing cost savings, played key roles in the quarter’s improved profitability. Additionally, enhanced net interest margin was achieved through effective funding strategies and asset repricing, while noninterest income benefited from new customer fee streams and expanded business lines.

Via StockStory · January 29, 2026

S&T Bancorp’s fourth quarter results garnered a positive market response, with management attributing performance to commercial lending strength, disciplined deposit growth, and improved net interest margins. CEO Chris McComish highlighted the company’s ability to expand the net interest margin to 3.99%, the highest since 2023, and pointed to robust commercial and industrial (C&I) and commercial real estate (CRE) loan activity. The quarter also saw continued success in reducing criticized and classified loans, reflecting a focus on asset quality, while a new $100 million share repurchase program was announced, enabled by strong capital levels.

Via StockStory · January 29, 2026

Texas Capital Bank’s fourth quarter was marked by solid performance, with management crediting the company’s ongoing transformation and focus on high-value client segments for its financial results. CEO Rob Holmes pointed to the firm’s “record adjusted total revenue” and emphasized that profitability improvements were driven by disciplined execution, operational efficiency, and an expanded fee income base. The quarter’s results reflected continued growth in commercial loans and interest-bearing deposits, as well as a notable increase in fee-based businesses such as treasury products and investment banking.

Via StockStory · January 29, 2026

Old Republic International’s fourth quarter was marked by strong revenue growth but fell short of Wall Street’s profitability expectations, leading to a significant negative market reaction. Management attributed the underperformance to higher loss ratios in commercial auto as well as increased expense ratios from ongoing investments in technology and new specialty operations. CEO Craig Smiddy described the company’s response as “immediate and conservative,” highlighting swift adjustments to loss reserves and a focus on pricing discipline as claim trends deteriorated late in the quarter. The company also noted favorable prior-year reserve development, but this was offset by an unexpected credit loss on a large deductible program within workers’ compensation.

Via StockStory · January 29, 2026

Eastern Bank’s fourth quarter results were met with a negative market reaction, despite the company beating Wall Street’s revenue and non-GAAP profit expectations. Management attributed the quarter’s performance to the successful integration of the HarborOne merger, robust organic loan growth—particularly within the commercial lending segment—and record-high wealth management assets. CEO Denis Sheahan emphasized the impact of recent talent investments and noted, “Our lending teams, both new hires and long-tenured relationship managers, remain energized.”

Via StockStory · January 29, 2026

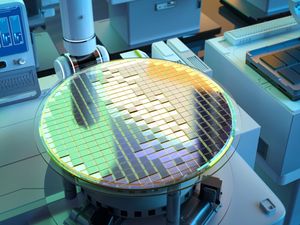

Semiconductor equipment maker Lam Research (NASDAQ:LRCX) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 22.1% year on year to $5.34 billion. On top of that, next quarter’s revenue guidance ($5.7 billion at the midpoint) was surprisingly good and 6.2% above what analysts were expecting. Its non-GAAP profit of $1.27 per share was 8.7% above analysts’ consensus estimates.

Via StockStory · January 29, 2026

Freight transportation intermediary C.H. Robinson (NASDAQ:CHRW) fell short of the markets revenue expectations in Q4 CY2025, with sales falling 6.5% year on year to $3.91 billion. Its non-GAAP profit of $1.23 per share was 9.2% above analysts’ consensus estimates.

Via StockStory · January 29, 2026

Byline Bancorp’s fourth quarter saw revenue and adjusted earnings per share surpass Wall Street expectations, but the market responded negatively, reflecting concerns over operating income and margin pressures. Management attributed the quarter’s growth to robust commercial loan activity, disciplined deposit pricing, and resilience in net interest income despite persistent macroeconomic and regulatory challenges. CEO Alberto Paracchini highlighted the successful integration of the First Security acquisition and progress on technology upgrades, while noting that deposit costs came down and asset quality remained stable. The company’s focus on organic growth, particularly in its core Chicago commercial business and new commercial payments segment, was central to its solid performance in the face of an evolving interest rate environment.

Via StockStory · January 29, 2026

Freight delivery company Landstar (NASDAQ:LSTR) fell short of the markets revenue expectations in Q4 CY2025, with sales falling 2.9% year on year to $1.18 billion. Its non-GAAP profit of $0.75 per share was 31.3% below analysts’ consensus estimates.

Via StockStory · January 29, 2026

Atlantic Union Bankshares’ fourth quarter results reflected the impact of its Sandy Spring acquisition and operational discipline, with management calling out successful integration and a more efficient cost structure. CEO John Asbury pointed to “disciplined execution and successful integration of the Sandy Springs acquisition” as a key driver, noting that merger-related charges continued to affect reported results. The quarter also benefited from record loan production, a rebound in commercial lending pipelines, and deposit cost reductions that helped expand net interest margin. Management acknowledged ongoing macroeconomic uncertainty but emphasized that underlying operating performance was strong, supported by resilient credit quality and steady asset growth.

Via StockStory · January 29, 2026

GE Aerospace ended Q4 with results above Wall Street’s expectations, but the market reacted negatively as investors weighed operational execution against future risks. Management attributed the strong revenue growth to robust commercial services demand and improved output from both its commercial and defense segments. CEO Larry Culp emphasized the company’s “substantial improvement across all key metrics,” driven by higher shop visit volumes, expanded aftermarket services, and productivity gains from operational streamlining. CFO Rahul Ghai highlighted that increased material availability and better execution on the shop floor led to improved turnaround times, particularly for LEAP and CFM56 engines.

Via StockStory · January 29, 2026

Cohen & Steers’ fourth quarter results met Wall Street’s expectations for both revenue and non-GAAP earnings, but the market responded negatively due to a significant decline in operating margin. Management pointed to higher general and administrative expenses, largely driven by business development and talent acquisition, as a key reason for the margin compression. CEO Joseph Harvey highlighted continued net inflows and stable fee rates across most vehicles, while also acknowledging that U.S. REIT strategies underperformed other asset classes. CFO Michael Donohue noted, “Total expenses were higher compared to the prior quarter, primarily due to increased G&A expense.”

Via StockStory · January 29, 2026

Network testing solutions company Viavi Solutions (NASDAQ:VIAV) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 36.4% year on year to $369.3 million. On top of that, next quarter’s revenue guidance ($393 million at the midpoint) was surprisingly good and 10% above what analysts were expecting. Its non-GAAP profit of $0.22 per share was 17.2% above analysts’ consensus estimates.

Via StockStory · January 29, 2026

Independent Bank’s fourth quarter results were driven by a combination of expanding net interest margins, strong commercial loan growth, and stable deposit inflows, offsetting lower noninterest income related to mortgage servicing. CEO Brad Kessel highlighted “continued net interest margin expansion, strong loan growth, and increased noninterest income,” with performance supported by disciplined management of costs and credit quality. Management attributed the quarter’s results to growth in commercial lending, effective repricing strategies for funding costs, and ongoing efforts to optimize asset mix.

Via StockStory · January 29, 2026

Northern Trust’s fourth quarter saw positive market reaction, as revenue and profit surpassed Wall Street expectations. Management credited strong trust fee growth, higher net interest income, and robust client flows, particularly in its global family office and ultra-high-net-worth segments, for the outperformance. CEO Michael O’Grady emphasized that “deepened client relationships and expanded market share” were central to the company’s execution, supported by strategic efforts in private markets, capital markets, and enhanced operational efficiency through AI-driven automation.

Via StockStory · January 29, 2026

Procter & Gamble’s fourth quarter results were met with a positive market reaction, reflecting management’s focus on product innovation and regional execution in the face of challenging market dynamics. CEO Shailesh Jejurikar cited targeted interventions in categories such as baby care in China and fabric care in Mexico, emphasizing the impact of consumer-driven innovation and sharper brand communication. While organic sales were flat and volumes declined slightly, management highlighted that outside the U.S., most regions experienced growth or acceleration, attributing this to the effectiveness of localized strategies and investments made earlier in the year.

Via StockStory · January 29, 2026

Aerospace and defense company General Dynamics (NYSE:GD) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 7.8% year on year to $14.38 billion. Its non-GAAP profit of $4.17 per share was 1.3% above analysts’ consensus estimates.

Via StockStory · January 29, 2026

Elevator manufacturer Otis (NYSE:OTIS) missed Wall Street’s revenue expectations in Q4 CY2025 as sales rose 3.3% year on year to $3.80 billion. The company’s full-year revenue guidance of $15.15 billion at the midpoint came in 0.7% below analysts’ estimates. Its non-GAAP profit of $1.03 per share was in line with analysts’ consensus estimates.

Via StockStory · January 29, 2026

CSX’s fourth quarter results came in below Wall Street’s revenue and profit expectations, yet the market responded positively, reflecting confidence in the company’s operational and cost management strategies. Management highlighted that modest volume growth was achieved despite headwinds in key markets such as chemicals and forest products. CEO Steve Angel attributed performance to improved service reliability, continued safety gains, and ongoing efforts to optimize costs and productivity. The quarter included $50 million in expenses tied to workforce and technology restructuring—actions aimed at aligning the business with current market conditions and supporting future profitability.

Via StockStory · January 29, 2026

LSI’s fourth quarter results were well received by the market, as the company’s flat sales masked meaningful progress beneath the surface. Management credited strong execution in the Lighting segment, with 15% year-over-year sales growth and improved margins, as a key driver this quarter. CEO James Clark pointed out that, despite a challenging comparison due to last year’s event-driven grocery demand, the company’s ability to maintain stable operating margins reflected disciplined project pricing and operational improvements. Management also highlighted robust free cash flow and continued customer engagement across core verticals.

Via StockStory · January 29, 2026

Health insurance provider Elevance Health (NYSE:EVH) fell short of the markets revenue expectations in Q4 CY2025, but sales rose 9.6% year on year to $49.31 billion. Its non-GAAP profit of $3.33 per share was 7.7% above analysts’ consensus estimates.

Via StockStory · January 29, 2026

Medical tech company CONMED (NYSE:CNMD) announced better-than-expected revenue in Q4 CY2025, with sales up 7.9% year on year to $373.2 million. On the other hand, the company’s full-year revenue guidance of $1.36 billion at the midpoint came in 0.7% below analysts’ estimates. Its non-GAAP profit of $1.43 per share was 8% above analysts’ consensus estimates.

Via StockStory · January 29, 2026

Capital One’s fourth quarter results were met with a negative market reaction, as investors digested the impact of higher expenses and missed profit expectations despite strong revenue growth. Management attributed the topline momentum to the integration of Discover, which boosted purchase volumes and overall loan balances. CEO Richard Fairbank acknowledged that “marketing continues to deliver strong new account originations,” but noted increased operating and marketing costs, particularly tied to the ongoing integration and investments in premium customer experiences. CFO Andrew Young highlighted a significant increase in the provision for credit losses, driven by higher allowances and net charge-offs, while emphasizing stable credit metrics and improved charge-off rates.

Via StockStory · January 29, 2026

The tech giant will soon provide shareholders with its Q4 2025 financial results.

Via The Motley Fool · January 29, 2026

In this video, we break down what the earnings report means for the stock technically, highlight key support and resistance levels, and outline a potential bullish trade setup that could emerge if the price holds or breaks through the right zones.

Via Talk Markets · January 29, 2026

The Technology Select Sector SPDR Fund spreads exposure across tech, while the Roundhill Generative AI and Technology ETF concentrates it around AI. This ETF comparison shows why that difference matters when AI valuations come under pressure.

Via The Motley Fool · January 29, 2026

Serina Therapeutics shares jumped nearly 35% after the FDA cleared its IND application for SER-252, advancing plans for a Phase 1b trial in advanced Parkinson's disease.

Via Benzinga · January 29, 2026

Gold prolongs its record-setting rally for the ninth straight day and advances over 3% on Thursday, climbing to the $5,600 neighborhood during the Asian session.

Via Talk Markets · January 29, 2026

Although Robinhood Markets has outpaced the broader market over the past year, Wall Street analysts maintain a cautiously optimistic outlook about the stock’s prospects.

Via Barchart.com · January 28, 2026

Lam Research joined ASML in posting upbeat financial numbers.

Via Stocktwits · January 28, 2026

Newsom leads in prediction markets for 2028 Democratic nominee race with 33% probability, followed by AOC (10%) and Josh Shapiro (9%).

Via Benzinga · January 28, 2026

Tether Gold and Pax Gold both climbed nearly 6% in 24 hours, tracking gold’s move above $5,500 per ounce for the first time.

Via Stocktwits · January 28, 2026

Japan's stock market reached all-time highs in 2026 because of some simple regulatory changes behind the scenes.

Via The Motley Fool · January 28, 2026

Intel stock has been surging of late, but the business is still well behind this manufacturing leader.

Via The Motley Fool · January 28, 2026

Meta CEO Mark Zuckerberg says the company is looking beyond video toward immersive, interactive content with Horizon Worlds and AI on mobile, as Meta beats Q4 revenue and earnings estimates and sees a strong after-hours stock surge.

Via Benzinga · January 28, 2026

Greenland rejects Trump's suggestion of US sovereignty over Arctic base, calling it unacceptable. Trump's proposed deal with NATO sparks tensions.

Via Benzinga · January 28, 2026