Medical technology company Enovis Corporation (NYSE:ENOV) reported Q2 CY2025 results exceeding the market’s revenue expectations, with sales up 7.5% year on year to $564.5 million. The company’s full-year revenue guidance of $2.26 billion at the midpoint came in 1.1% above analysts’ estimates. Its non-GAAP profit of $0.79 per share was 9.9% above analysts’ consensus estimates.

Is now the time to buy Enovis? Find out by accessing our full research report, it’s free.

Enovis (ENOV) Q2 CY2025 Highlights:

- Revenue: $564.5 million vs analyst estimates of $553.5 million (7.5% year-on-year growth, 2% beat)

- Adjusted EPS: $0.79 vs analyst estimates of $0.72 (9.9% beat)

- Adjusted EBITDA: $97.2 million vs analyst estimates of $94.42 million (17.2% margin, 2.9% beat)

- The company lifted its revenue guidance for the full year to $2.26 billion at the midpoint from $2.24 billion, a 1.1% increase

- Management raised its full-year Adjusted EPS guidance to $3.13 at the midpoint, a 3.3% increase

- EBITDA guidance for the full year is $397 million at the midpoint, above analyst estimates of $387.7 million

- Operating Margin: -3%, up from -8.4% in the same quarter last year

- Free Cash Flow was $3.4 million, up from -$31.63 million in the same quarter last year

- Market Capitalization: $1.47 billion

Damien McDonald, Chief Executive Officer of Enovis, said, “My first 90 days have strengthened my belief that Enovis has the foundation, portfolio, and momentum to drive durable, profitable growth. Realizing this potential will require continued operational discipline and a sharp focus on scalable, capital efficient execution. We are in the early stages of unlocking the full value of our orthopedic platform, and I’m excited to lead the Company with a commitment to continue helping millions of people lead full, active lives with a focus on creating shareholder value. Our second-quarter performance reflects the strength of our diversified global portfolio and the opportunity ahead. I’m grateful to the Board and the entire Enovis team for their support and alignment on our strategy.”

Company Overview

With a focus on helping patients regain or maintain their natural motion, Enovis (NYSE:ENOV) develops and manufactures medical devices for orthopedic care, from injury prevention and pain management to joint replacement and rehabilitation.

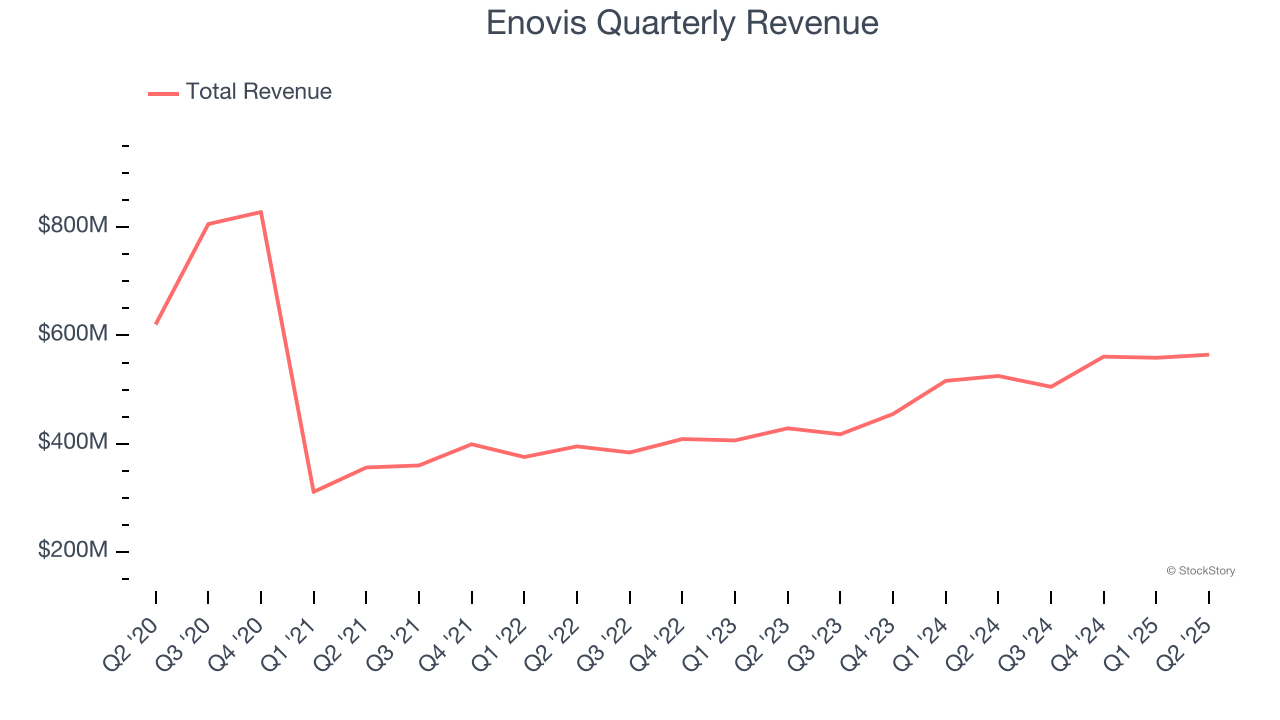

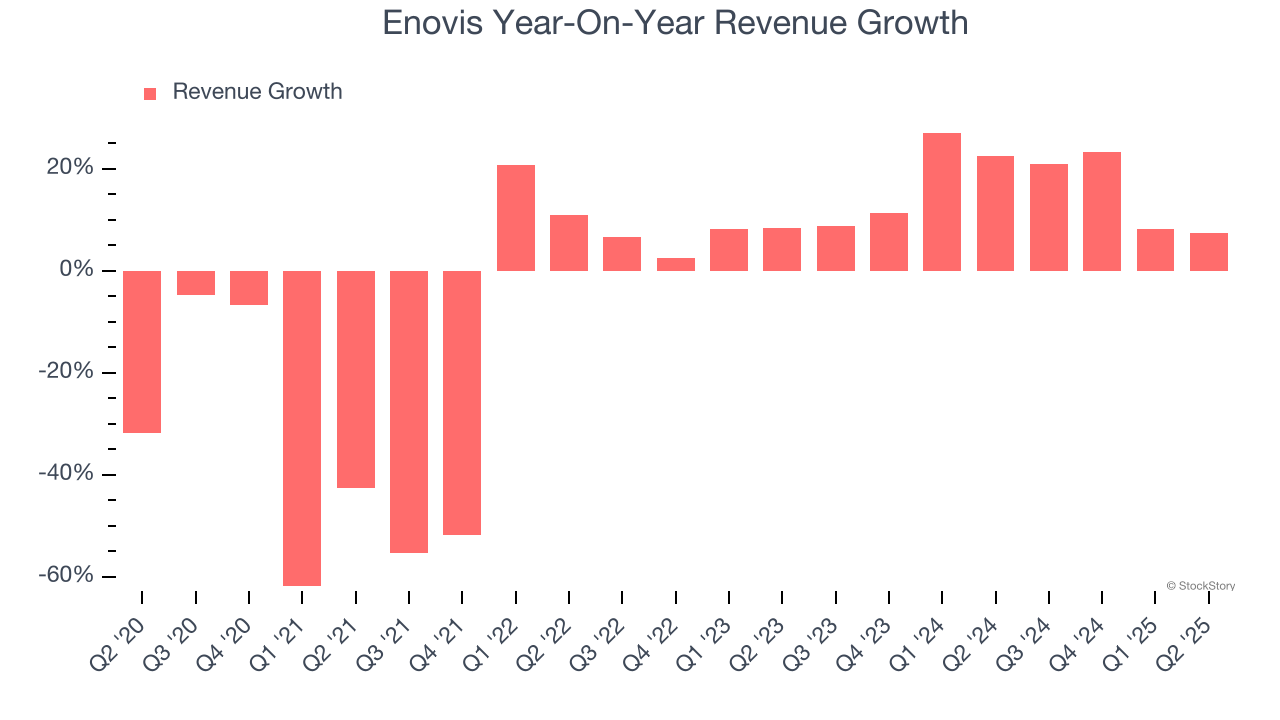

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Enovis struggled to consistently generate demand over the last five years as its sales dropped at a 7.1% annual rate. This was below our standards and suggests it’s a low quality business.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Enovis’s annualized revenue growth of 16% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

This quarter, Enovis reported year-on-year revenue growth of 7.5%, and its $564.5 million of revenue exceeded Wall Street’s estimates by 2%.

Looking ahead, sell-side analysts expect revenue to grow 5% over the next 12 months, a deceleration versus the last two years. Still, this projection is above average for the sector and implies the market is forecasting some success for its newer products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

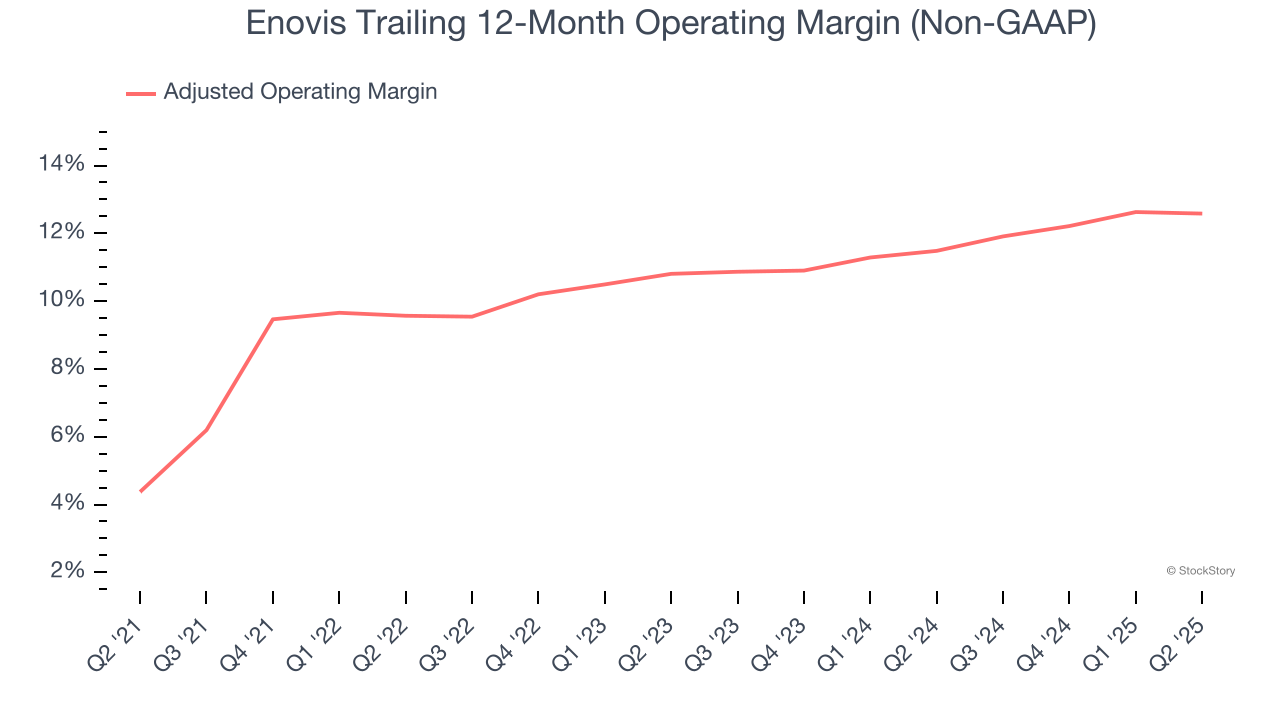

Adjusted Operating Margin

Adjusted operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D. It also removes various one-time costs to paint a better picture of normalized profits.

Enovis was profitable over the last five years but held back by its large cost base. Its average adjusted operating margin of 9.6% was weak for a healthcare business.

On the plus side, Enovis’s adjusted operating margin rose by 8.2 percentage points over the last five years. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 1.8 percentage points on a two-year basis.

In Q2, Enovis generated an adjusted operating margin profit margin of 11.3%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

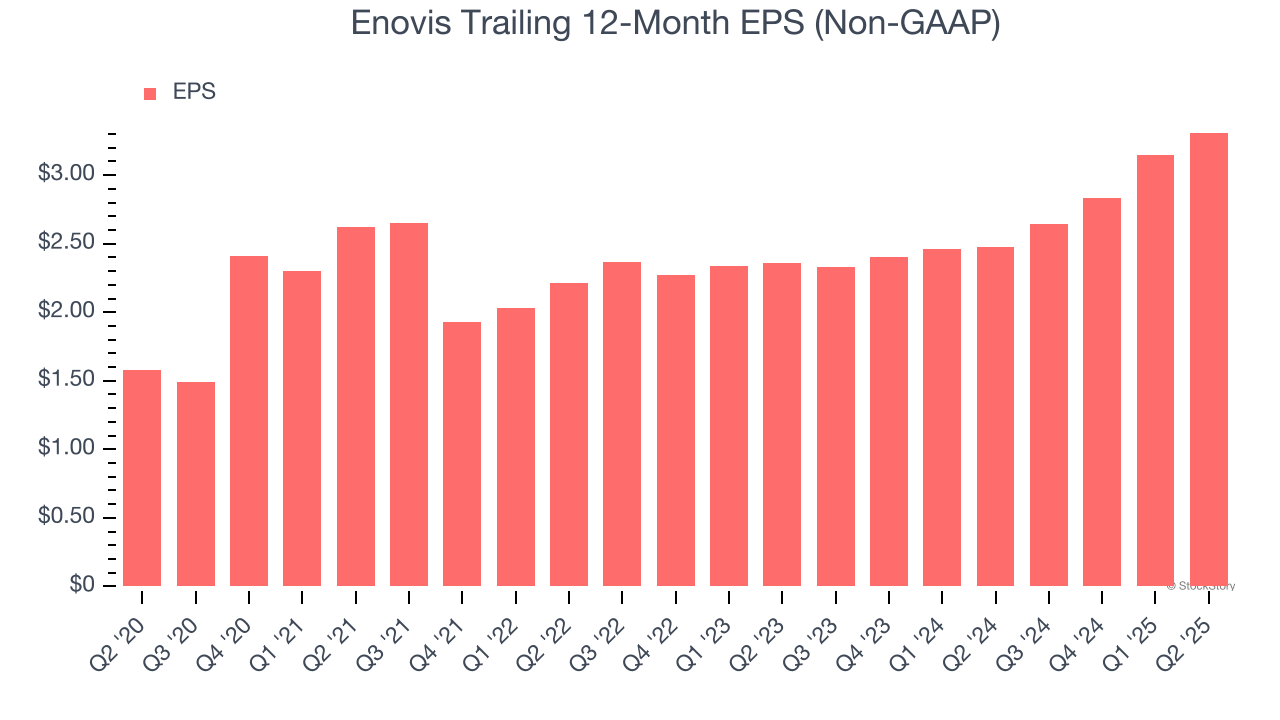

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Enovis’s EPS grew at an astounding 15.9% compounded annual growth rate over the last five years, higher than its 7.1% annualized revenue declines. This tells us management adapted its cost structure in response to a challenging demand environment.

We can take a deeper look into Enovis’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Enovis’s adjusted operating margin was flat this quarter but expanded by 8.2 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q2, Enovis reported adjusted EPS at $0.79, up from $0.62 in the same quarter last year. This print beat analysts’ estimates by 9.9%. Over the next 12 months, Wall Street expects Enovis’s full-year EPS of $3.31 to shrink by 6.2%.

Key Takeaways from Enovis’s Q2 Results

We enjoyed seeing Enovis beat analysts’ full-year EPS guidance expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 10.3% to $28.41 immediately after reporting.

Enovis put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.