Let’s dig into the relative performance of United Rentals (NYSE:URI) and its peers as we unravel the now-completed Q2 specialty equipment distributors earnings season.

Historically, specialty equipment distributors have boasted deep selection and expertise in sometimes narrow areas like single-use packaging or unique lighting equipment. Additionally, the industry has evolved to include more automated industrial equipment and machinery over the last decade, driving efficiencies and enabling valuable data collection. Specialty equipment distributors whose offerings keep up with these trends can take share in a still-fragmented market, but like the broader industrials sector, this space is at the whim of economic cycles that impact the capital spending and manufacturing propelling industry volumes.

The 8 specialty equipment distributors stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 2% while next quarter’s revenue guidance was 2.6% below.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

United Rentals (NYSE:URI)

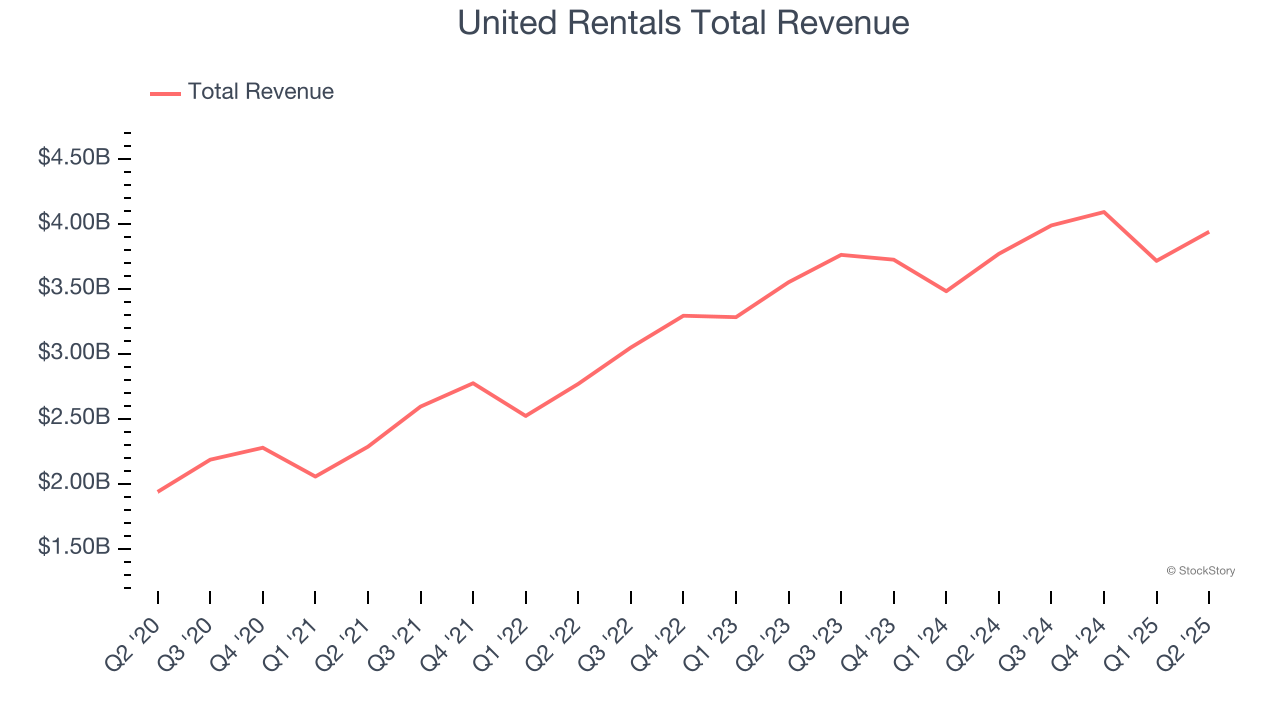

Owning the largest rental fleet in the world, United Rentals (NYSE:URI) provides equipment rental and related services to construction, industrial, and infrastructure industries.

United Rentals reported revenues of $3.94 billion, up 4.5% year on year. This print exceeded analysts’ expectations by 0.8%. Overall, it was a strong quarter for the company with a solid beat of analysts’ adjusted operating income estimates and full-year EBITDA guidance slightly topping analysts’ expectations.

Interestingly, the stock is up 8.8% since reporting and currently trades at $869.70.

Is now the time to buy United Rentals? Access our full analysis of the earnings results here, it’s free.

Best Q2: Hudson Technologies (NASDAQ:HDSN)

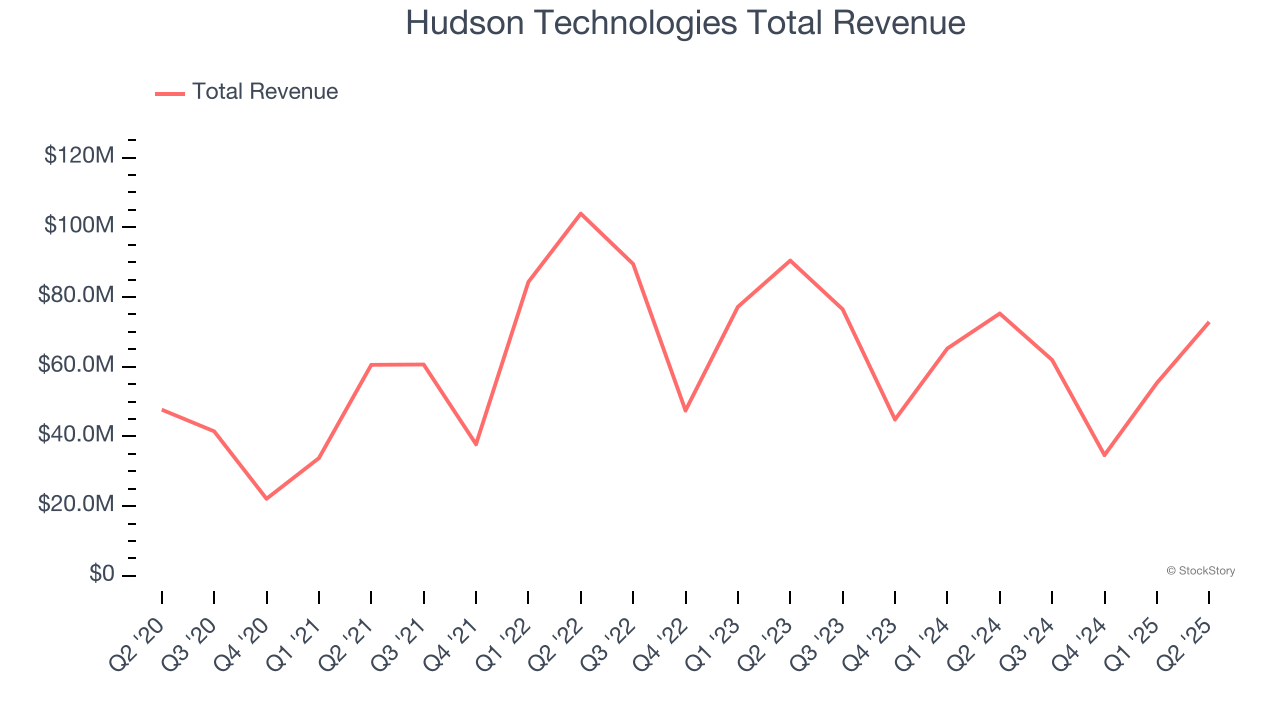

Founded in 1991, Hudson Technologies (NASDAQ:HDSN) specializes in refrigerant services and solutions, providing refrigerant sales, reclamation, and recycling.

Hudson Technologies reported revenues of $72.85 million, down 3.2% year on year, outperforming analysts’ expectations by 1.7%. The business had a stunning quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 15.5% since reporting. It currently trades at $9.60.

Is now the time to buy Hudson Technologies? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Karat Packaging (NASDAQ:KRT)

Founded as Lollicup, Karat Packaging (NASDAQ: KRT) distributes and manufactures environmentally-friendly disposable foodservice packaging solutions.

Karat Packaging reported revenues of $124 million, up 10.1% year on year, in line with analysts’ expectations. It was a slower quarter as it posted a significant miss of analysts’ EPS estimates and revenue guidance for next quarter missing analysts’ expectations.

As expected, the stock is down 4.1% since the results and currently trades at $25.55.

Read our full analysis of Karat Packaging’s results here.

Herc (NYSE:HRI)

Formerly a subsidiary of Hertz Corporation and with a logo that still bears some similarities to its former parent, Herc Holdings (NYSE:HRI) provides equipment rental and related services to a wide range of industries.

Herc reported revenues of $1.00 billion, up 18.2% year on year. This number topped analysts’ expectations by 6.9%. However, it was a slower quarter as it recorded full-year revenue guidance missing analysts’ expectations significantly and full-year EBITDA guidance missing analysts’ expectations significantly.

Herc had the weakest full-year guidance update among its peers. The stock is down 26% since reporting and currently trades at $111.09.

Read our full, actionable report on Herc here, it’s free.

Alta (NYSE:ALTG)

Founded in 1984, Alta Equipment Group (NYSE:ALTG) is a provider of industrial and construction equipment and services across the Midwest and Northeast United States.

Alta reported revenues of $481.2 million, down 1.4% year on year. This print beat analysts’ expectations by 0.6%. Overall, it was an exceptional quarter as it also logged an impressive beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

The stock is up 6.4% since reporting and currently trades at $7.60.

Read our full, actionable report on Alta here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.