Workiva has gotten torched over the last six months - since February 2025, its stock price has dropped 21.9% to $71.12 per share. This may have investors wondering how to approach the situation.

Given the weaker price action, is now an opportune time to buy WK? Find out in our full research report, it’s free.

Why Does Workiva Spark Debate?

Founded in 2010, Workiva (NYSE:WK) offers software as a service product that makes financial and compliance reporting easier, especially for publicly traded corporations.

Two Things to Like:

1. Billings Surge, Boosting Cash On Hand

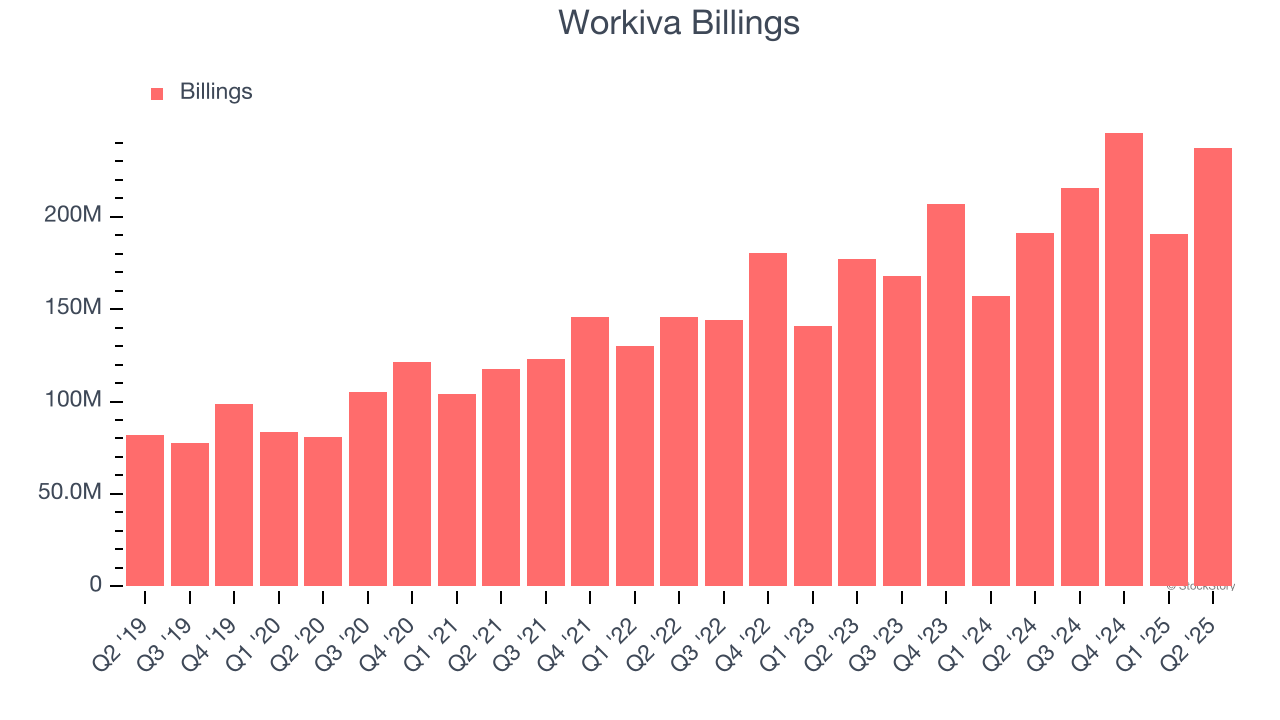

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Workiva’s billings punched in at $237.3 million in Q2, and over the last four quarters, its year-on-year growth averaged 23.2%. This performance was impressive, indicating robust customer demand. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

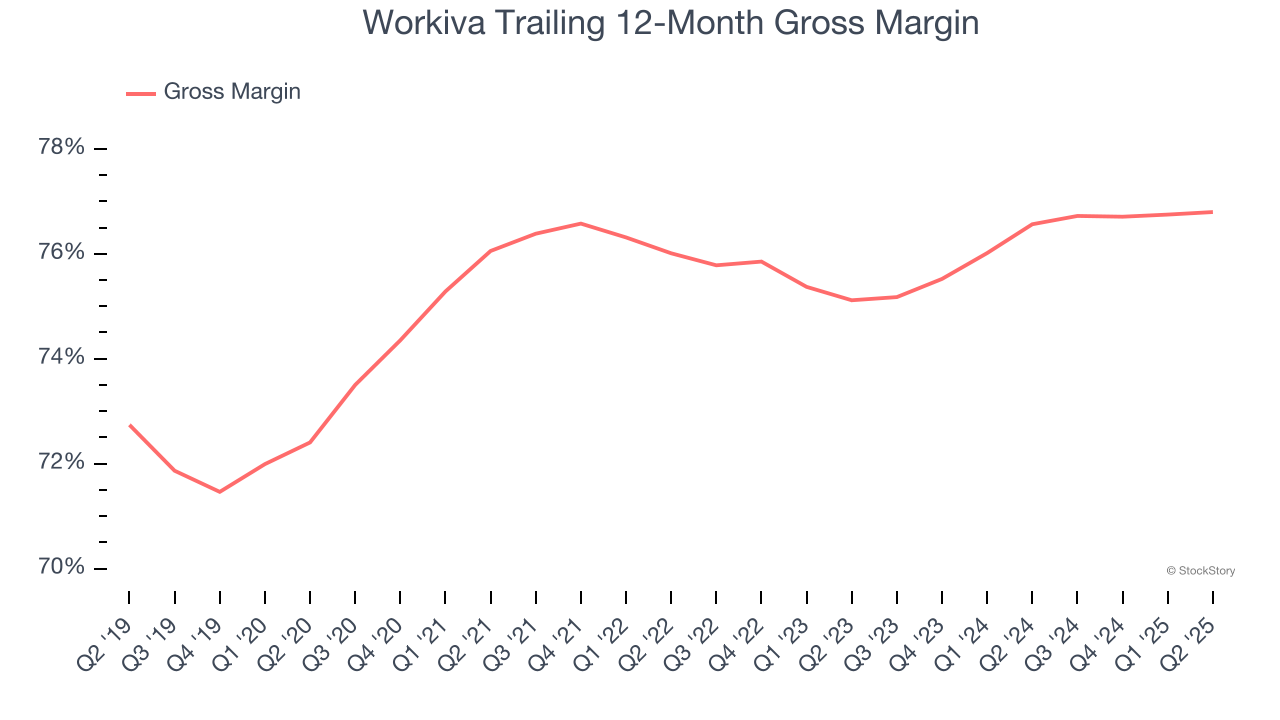

2. Elite Gross Margin Powers Best-In-Class Business Model

Software is eating the world. It’s one of our favorite business models because once you develop the product, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

Workiva’s robust unit economics are better than the broader software industry, an output of its asset-lite business model and pricing power. They also enable the company to fund large investments in new products and sales during periods of rapid growth to achieve outsized profits at scale. As you can see below, it averaged an excellent 76.8% gross margin over the last year. That means Workiva only paid its providers $23.20 for every $100 in revenue.

One Reason to be Careful:

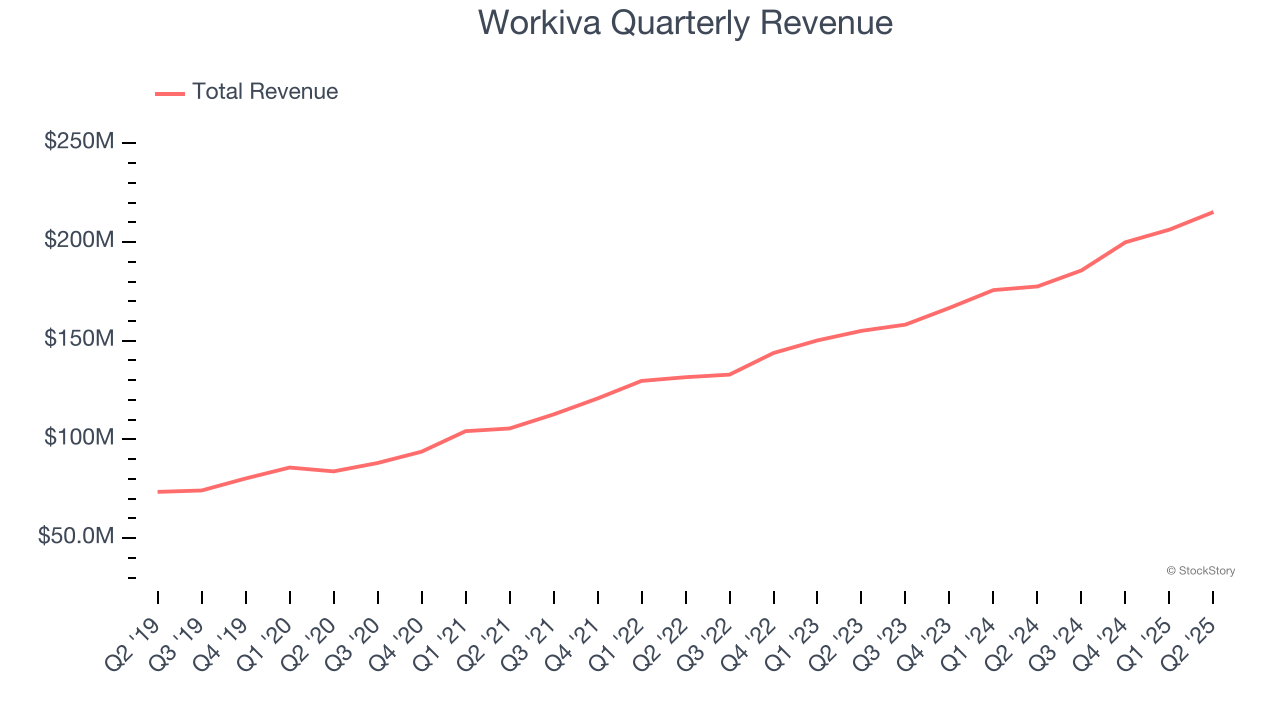

Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last three years, Workiva grew its sales at a 17.7% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds. Luckily, there are other things to like about Workiva.

Final Judgment

Workiva has huge potential even though it has some open questions. With the recent decline, the stock trades at 4.3× forward price-to-sales (or $71.12 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.