Broadband and telecommunications services provider WideOpenWest (NYSE:WOW) met Wall Street’s revenue expectations in Q2 CY2025, but sales fell by 9.2% year on year to $144.2 million. Its GAAP loss of $0.22 per share was 18.9% below analysts’ consensus estimates.

Is now the time to buy WideOpenWest? Find out by accessing our full research report, it’s free.

WideOpenWest (WOW) Q2 CY2025 Highlights:

- WideOpenWest has entered into an agreement to be taken private by DigitalBridge Group and Crestview Partners in a $1.5 billion transaction.

Shareholders will receive $5.20 per share in cash as part of the deal compared to today's closing price of $3.38 - Revenue: $144.2 million vs analyst estimates of $143.6 million (9.2% year-on-year decline, in line)

- EPS (GAAP): -$0.22 vs analyst expectations of -$0.19 (18.9% miss)

- Adjusted EBITDA: $70.3 million vs analyst estimates of $67.69 million (48.8% margin, 3.9% beat)

- Operating Margin: 1.7%, in line with the same quarter last year

- Free Cash Flow was -$11.8 million, down from $2.3 million in the same quarter last year

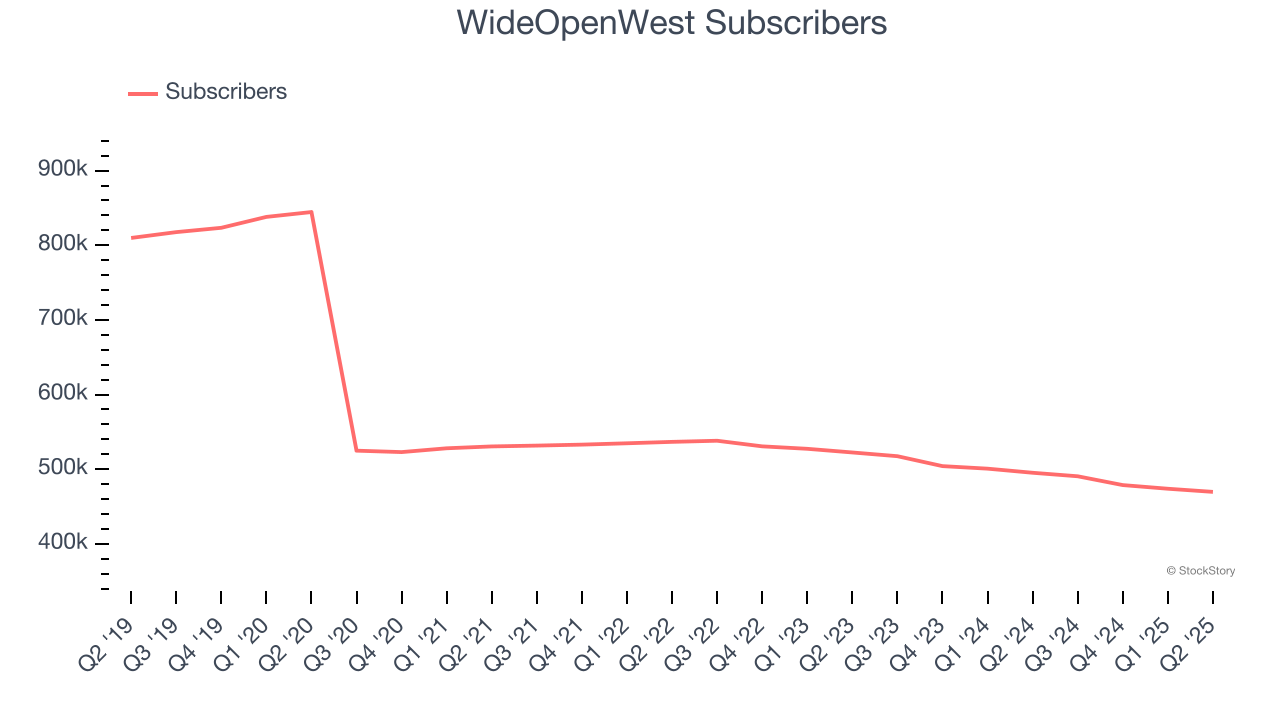

- Subscribers: 469,600, down 25,600 year on year

- Market Capitalization: $263.3 million

"During the second quarter we passed an additional 15,500 new homes in our all-fiber Greenfield markets. As we continue to accelerate our fiber-to-the-home expansion, we're seeing growth in HSD Greenfield subscribers and consistently strong penetration rates," said Teresa Elder, WOW!'s CEO.

Company Overview

Initially started in Denver as a cable television provider, WideOpenWest (NYSE:WOW) provides high-speed internet, cable, and telephone services to the Midwest and Southeast regions of the U.S.

Revenue Growth

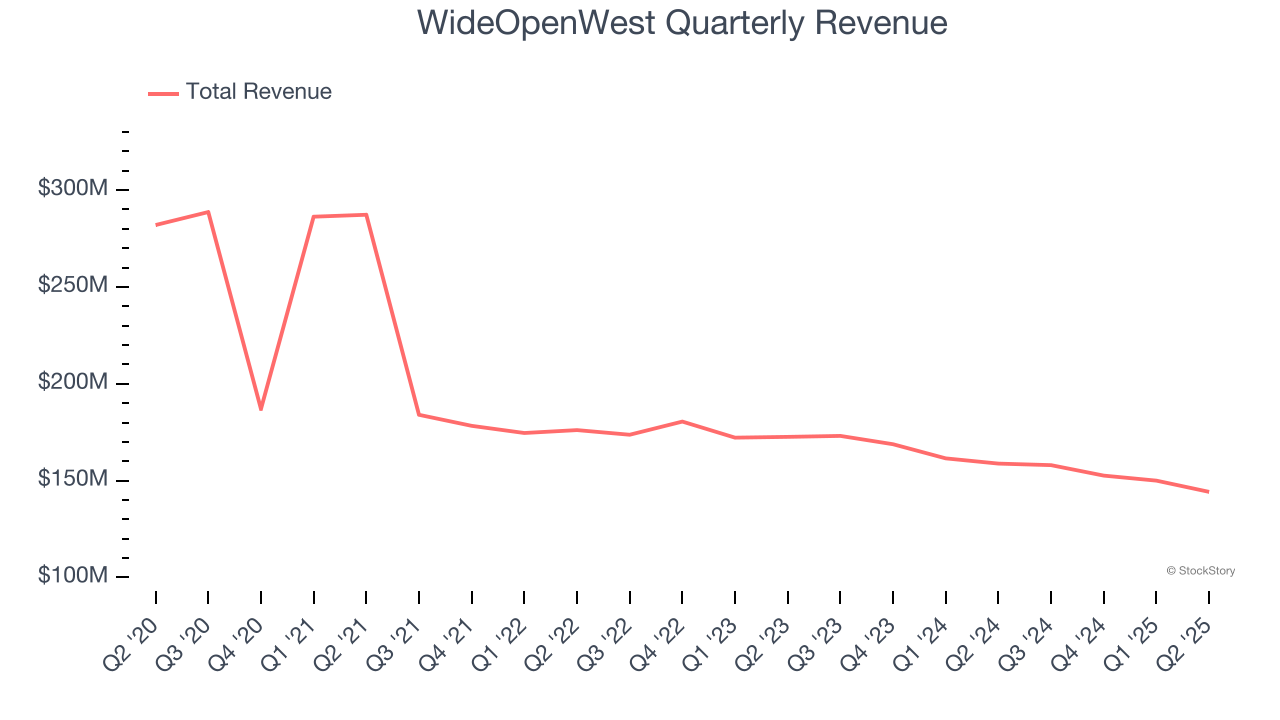

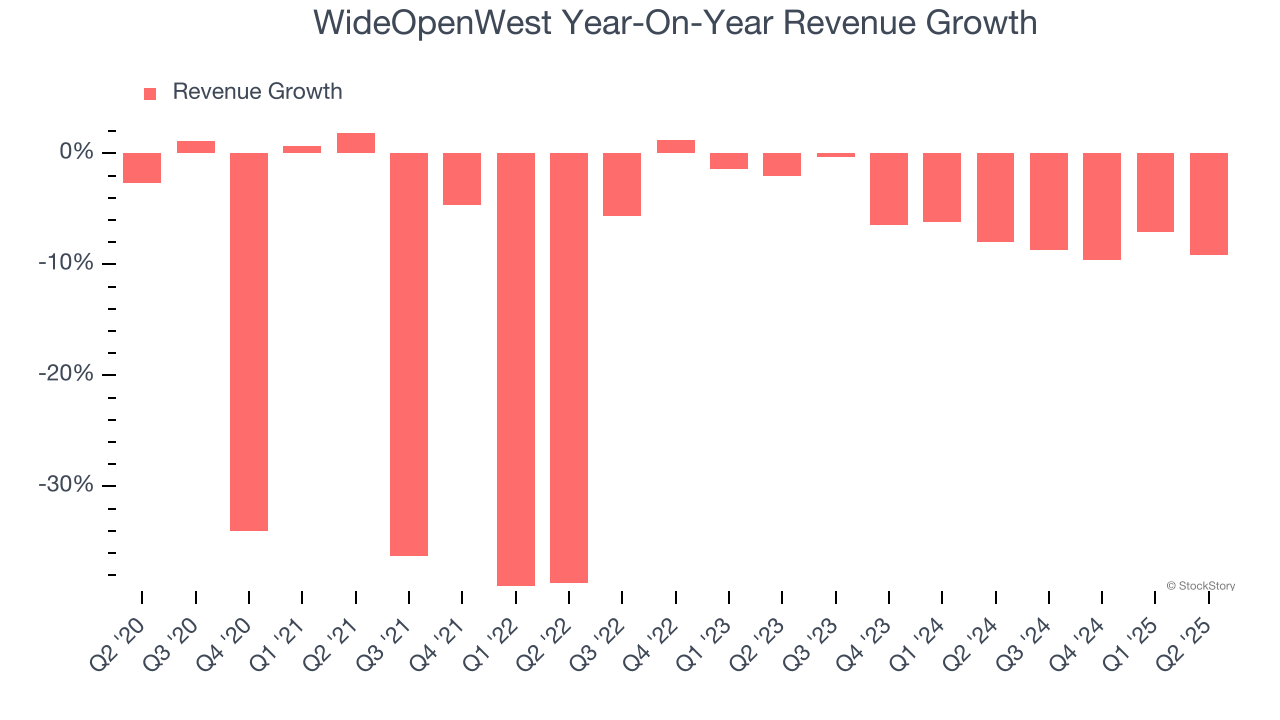

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. WideOpenWest’s demand was weak over the last five years as its sales fell at a 11.8% annual rate. This wasn’t a great result and suggests it’s a low quality business.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. WideOpenWest’s annualized revenue declines of 7% over the last two years suggest its demand continued shrinking.

We can better understand the company’s revenue dynamics by analyzing its number of subscribers, which reached 469,600 in the latest quarter. Over the last two years, WideOpenWest’s subscribers averaged 5% year-on-year declines. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, WideOpenWest reported a rather uninspiring 9.2% year-on-year revenue decline to $144.2 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to decline by 9.9% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and suggests its products and services will face some demand challenges.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

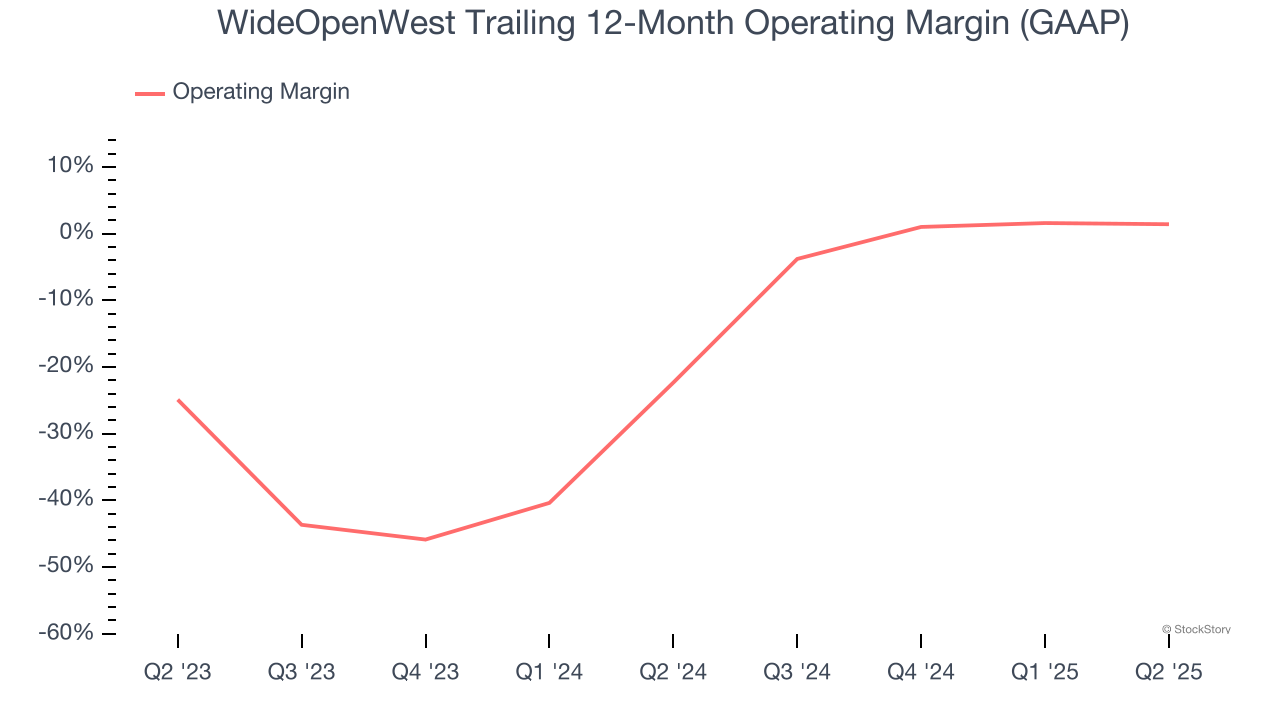

WideOpenWest’s operating margin has been trending up over the last 12 months, but it still averaged negative 11% over the last two years. This is due to its large expense base and inefficient cost structure.

This quarter, WideOpenWest generated an operating margin profit margin of 1.7%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

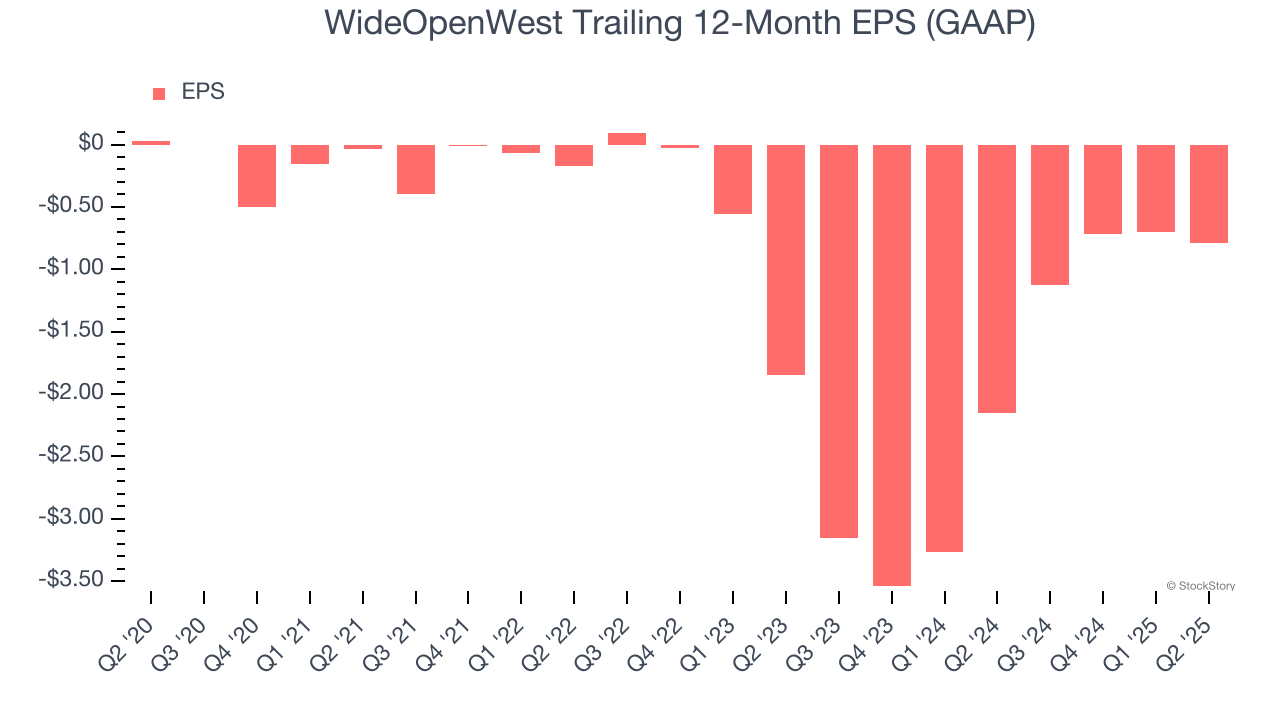

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for WideOpenWest, its EPS declined by 98.5% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q2, WideOpenWest reported EPS at negative $0.22, down from negative $0.13 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects WideOpenWest to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.79 will advance to negative $0.66.

Key Takeaways from WideOpenWest’s Q2 Results

WideOpenWest has entered into an agreement to be taken private by DigitalBridge Group and Crestview Partners in a $1.5 billion transaction. Shareholders will receive $5.20 per share in cash as part of the deal compared to today's closing price of $3.38. As for the quarter, it was encouraging to see WideOpenWest beat analysts’ EBITDA expectations this quarter. On the other hand, its EPS missed. The stock traded up 46.5% to $4.99 immediately after reporting based on news of the deal.