Call center software provider Five9 (NASDAQ: FIVN) announced better-than-expected revenue in Q2 CY2025, with sales up 12.4% year on year to $283.3 million. The company expects next quarter’s revenue to be around $284.5 million, close to analysts’ estimates. Its non-GAAP profit of $0.76 per share was 17% above analysts’ consensus estimates.

Is now the time to buy Five9? Find out by accessing our full research report, it’s free.

Five9 (FIVN) Q2 CY2025 Highlights:

- Revenue: $283.3 million vs analyst estimates of $275.2 million (12.4% year-on-year growth, 2.9% beat)

- Adjusted EPS: $0.76 vs analyst estimates of $0.65 (17% beat)

- Adjusted Operating Income: $54.45 million vs analyst estimates of $42.33 million (19.2% margin, 28.6% beat)

- The company slightly lifted its revenue guidance for the full year to $1.15 billion at the midpoint from $1.14 billion

- Management raised its full-year Adjusted EPS guidance to $2.88 at the midpoint, a 4.3% increase

- Operating Margin: -0.6%, up from -7.7% in the same quarter last year

- Free Cash Flow Margin: 7.6%, down from 12.5% in the previous quarter

- Market Capitalization: $2.08 billion

“We are pleased to report strong second quarter results which exceeded our expectations across all key metrics. Subscription revenue accelerated to 16% year-over-year growth, primarily driven by Enterprise AI revenue accelerating to 42% year-over-year growth and now representing 10% of Enterprise subscription revenue. Adjusted EBITDA margin increased to 24%, reaching an all-time record and helping drive a Q2 record for both operating and free cash flow. As we drive balanced, profitable growth, we are also seeing strong momentum in our sales execution with Enterprise AI bookings more than tripling year-over-year in the second quarter. Our customers are realizing meaningful benefits through our Genius AI suite of products as we continue to drive innovation with the recent launch of Agentic AI Agents and AI Trust & Governance. We remain at the forefront of developing leading agentic CX solutions to help reshape the customer journey and experience, and I’m extremely excited about the future of Five9.”

Company Overview

Started in 2001, Five9 (NASDAQ: FIVN) offers software-as-a-service that makes it easier for companies to set up and efficiently run call centers to offer more tailored customer support.

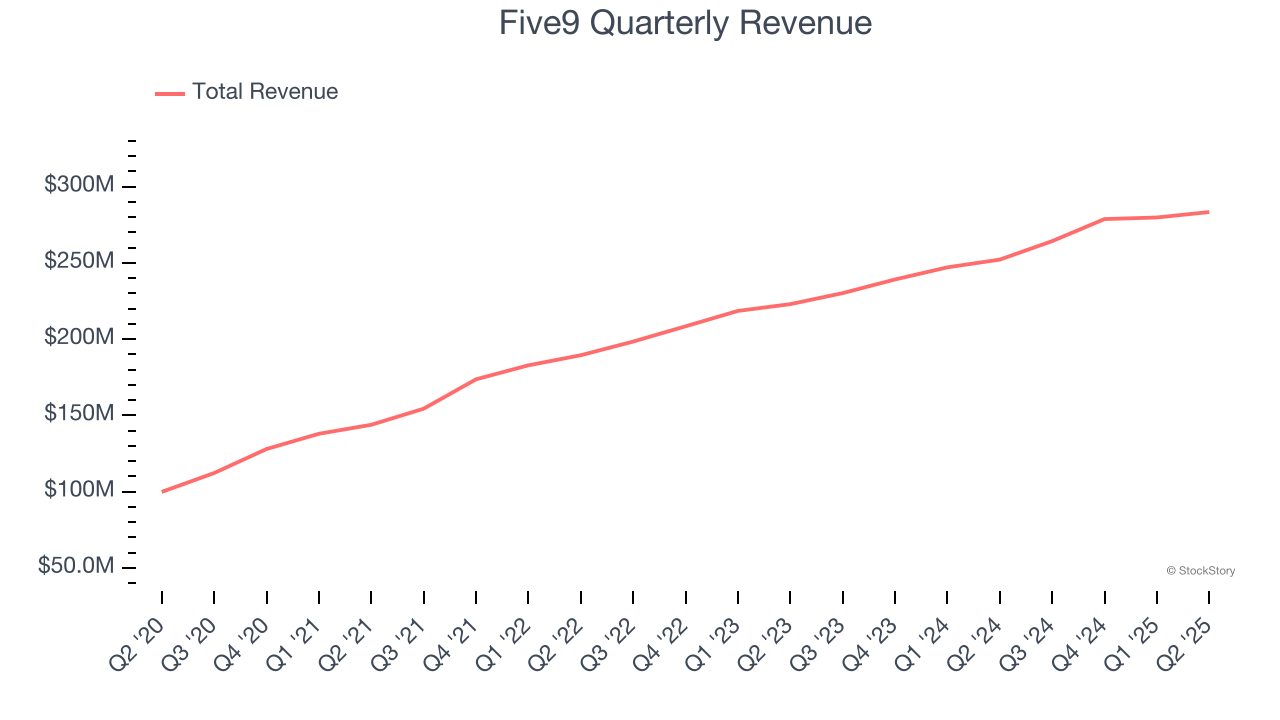

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last three years, Five9 grew its sales at a 16.5% annual rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds.

This quarter, Five9 reported year-on-year revenue growth of 12.4%, and its $283.3 million of revenue exceeded Wall Street’s estimates by 2.9%. Company management is currently guiding for a 7.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7.8% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

It’s relatively expensive for Five9 to acquire new customers as its CAC payback period checked in at 144 months this quarter. The company’s slow recovery of its sales and marketing expenses indicates it operates in a highly competitive market and must invest to stand out, even if the return on that investment is low.

Key Takeaways from Five9’s Q2 Results

We were impressed by how significantly Five9 blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year EPS guidance trumped Wall Street’s estimates. On the other hand, its revenue guidance for next quarter was in line. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 12.1% to $28.95 immediately after reporting.

Five9 may have had a good quarter, but does that mean you should invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.