Since January 2025, Mercury General has been in a holding pattern, floating around $65.82.

Is now the time to buy Mercury General, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Mercury General Not Exciting?

We're sitting this one out for now. Here are three reasons why you should be careful with MCY and a stock we'd rather own.

1. Deteriorating Pre-tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For insurance companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Insurance companies are balance sheet businesses, where assets and liabilities define the economics. Interest income and expense should therefore be factored into the definition of profit but taxes - which are largely out of a company’s control - should not. This is pre-tax profit by definition.

Over the last four years, Mercury General’s pre-tax profit margin has fallen by 12.8 percentage points, hitting 6.1% for the past 12 months. Said differently, the company’s expenses have increased at a faster rate than revenue, which is usually raises questions in mature industries (the exception is a high-growth company that reinvests its profits in attractive ventures).

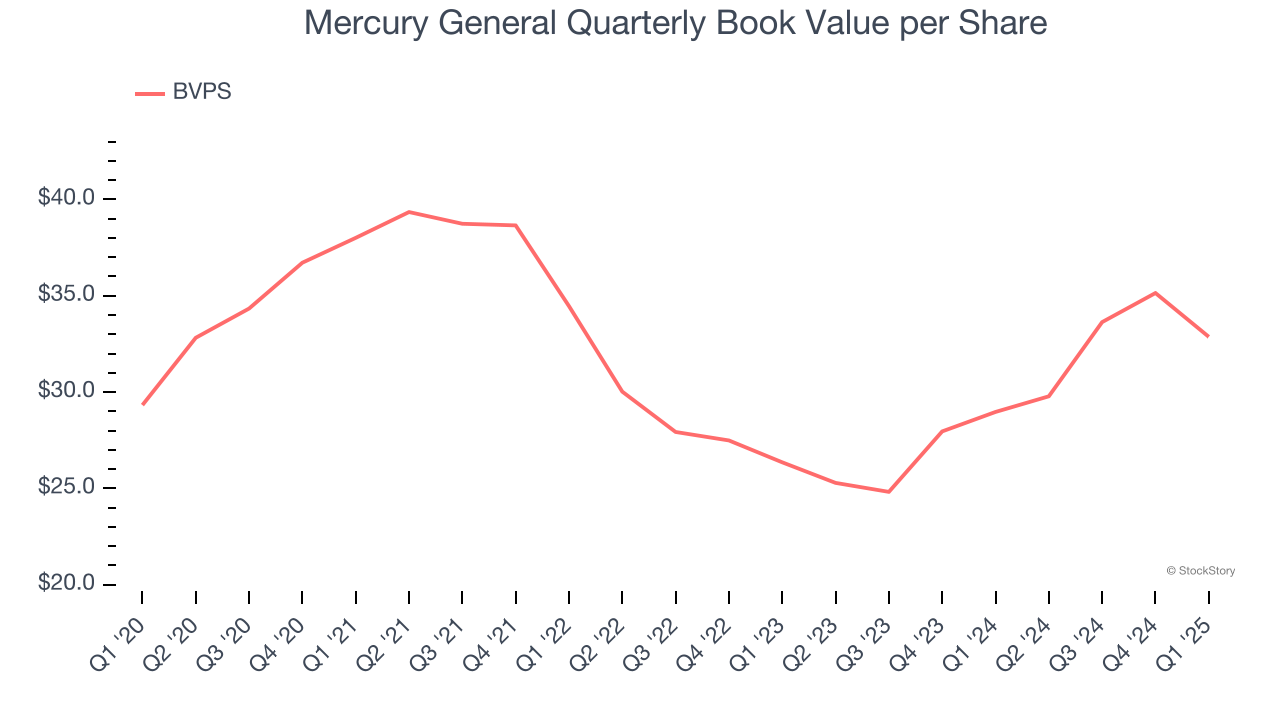

2. Substandard BVPS Growth Indicates Limited Asset Expansion

In the insurance industry, book value per share (BVPS) provides a clear picture of shareholder value, as it represents the total equity backing a company’s insurance operations and growth initiatives.

To the detriment of investors, Mercury General’s BVPS grew at a mediocre 11.7% annual clip over the last two years.

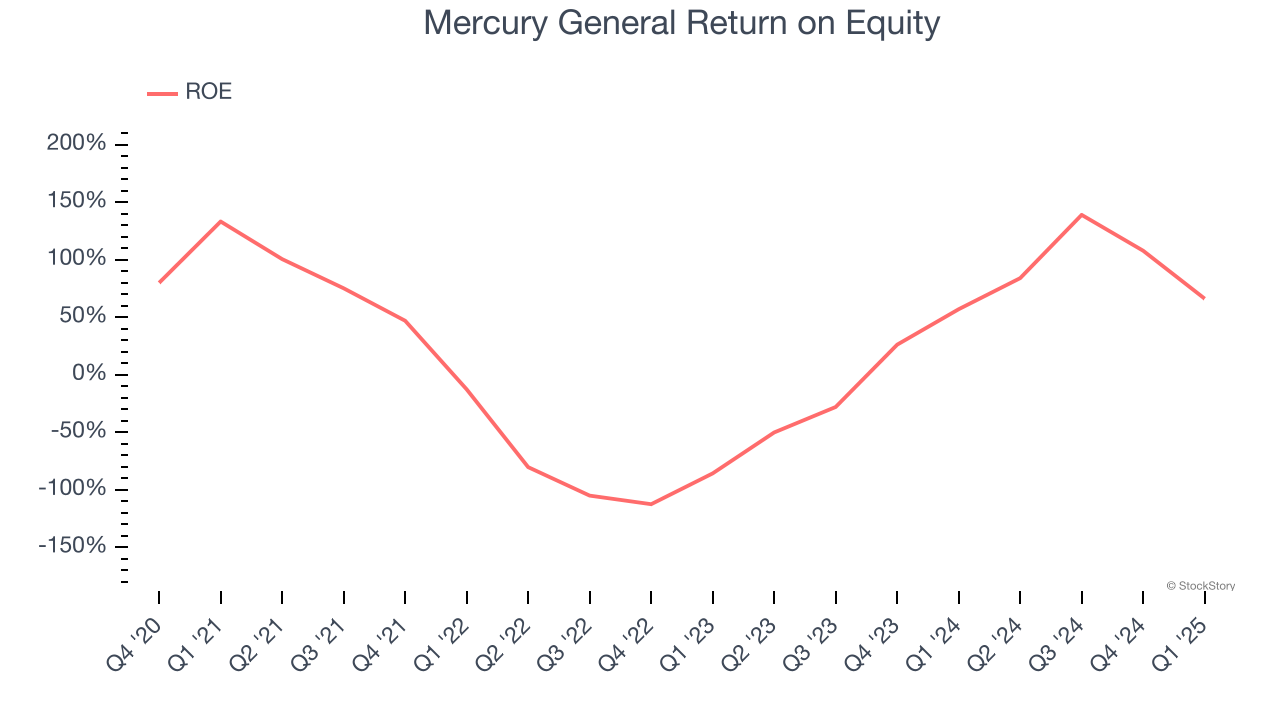

3. Previous Growth Initiatives Haven’t Impressed

Return on equity, or ROE, represents the ultimate measure of an insurer's effectiveness, quantifying how well it transforms shareholder investments into profits. Over the long term, insurance companies with robust ROE metrics typically deliver superior shareholder returns through a balanced approach to capital management.

Over the last five years, Mercury General has averaged an ROE of 7.9%, uninspiring for a company operating in a sector where the average shakes out around 12.5%.

Final Judgment

Mercury General isn’t a terrible business, but it isn’t one of our picks. That said, the stock currently trades at 1.9× forward P/B (or $65.82 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - you can find more timely opportunities elsewhere. Let us point you toward a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of Mercury General

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.