Earnings results often indicate what direction a company will take in the months ahead. With Q1 behind us, let’s have a look at Figs (NYSE:FIGS) and its peers.

Thanks to social media and the internet, not only are styles changing more frequently today than in decades past but also consumers are shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel and accessories companies have made concerted efforts to adapt while those who are slower to move may fall behind.

The 17 apparel and accessories stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Figs (NYSE:FIGS)

Rising to fame via TikTok and founded in 2013 by Heather Hasson and Trina Spear, Figs (NYSE:FIGS) is a healthcare apparel company known for its stylish approach to medical attire and uniforms.

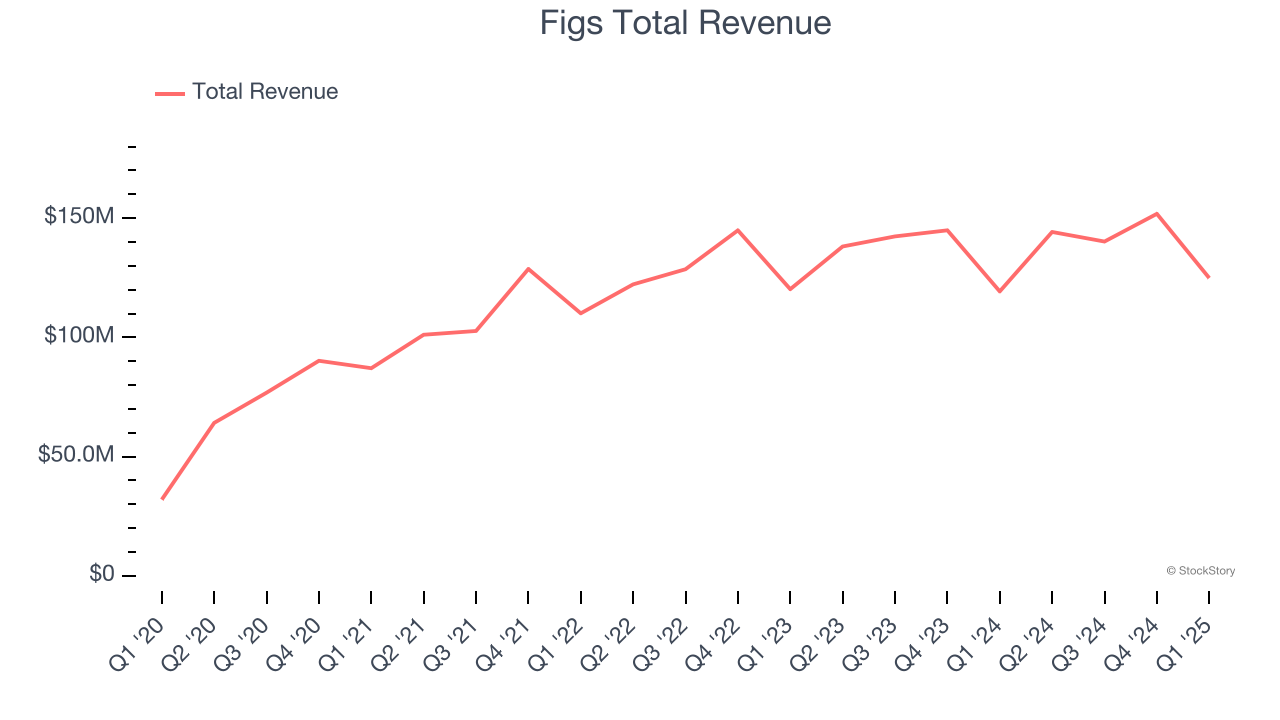

Figs reported revenues of $124.9 million, up 4.7% year on year. This print exceeded analysts’ expectations by 4.8%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ adjusted operating income estimates.

“First quarter results were ahead of expectations, supported by customer growth, strong full-priced selling, record AOV, and ultimately, a return to growth in the U.S.,” said Trina Spear, Chief Executive Officer and Co-Founder.

Figs pulled off the biggest analyst estimates beat of the whole group. The stock is up 5.7% since reporting and currently trades at $5.31.

Is now the time to buy Figs? Access our full analysis of the earnings results here, it’s free.

Best Q1: ThredUp (NASDAQ:TDUP)

Founded to revolutionize thrifting, ThredUp (NASDAQ:TDUP) is a leading online fashion resale marketplace offering a wide selection of gently-used clothing and accessories.

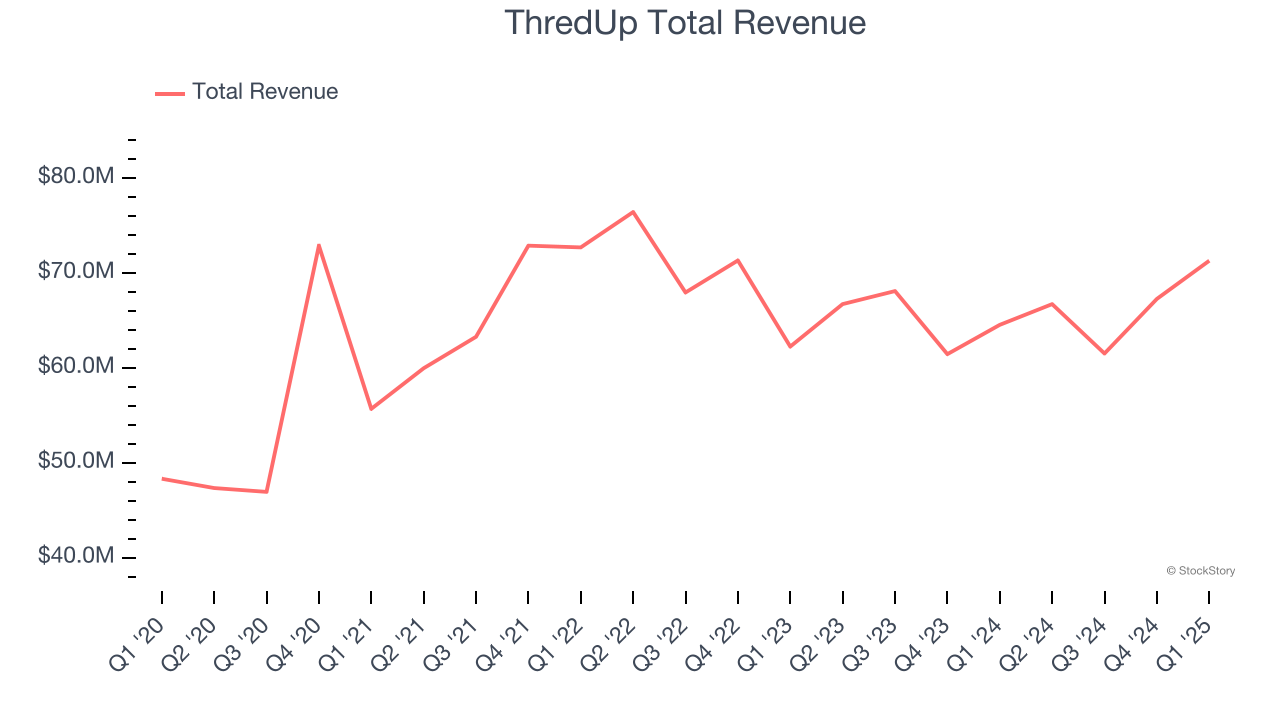

ThredUp reported revenues of $71.29 million, up 10.5% year on year, outperforming analysts’ expectations by 4.4%. The business had an exceptional quarter with an impressive beat of analysts’ EBITDA estimates.

ThredUp achieved the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 69.3% since reporting. It currently trades at $7.50.

Is now the time to buy ThredUp? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Movado (NYSE:MOV)

With its watches displayed in 20 museums around the world, Movado (NYSE:MOV) is a watchmaking company with a portfolio of watch brands and accessories.

Movado reported revenues of $131.8 million, down 1.9% year on year, falling short of analysts’ expectations by 7.3%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

Movado delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 11.9% since the results and currently trades at $15.38.

Read our full analysis of Movado’s results here.

PVH (NYSE:PVH)

Founded in 1881 by a husband and wife duo, PVH (NYSE:PVH) is a global fashion conglomerate with iconic brands like Calvin Klein and Tommy Hilfiger.

PVH reported revenues of $1.98 billion, up 1.6% year on year. This result beat analysts’ expectations by 2.6%. Taking a step back, it was a slower quarter as it produced full-year EPS guidance missing analysts’ expectations.

The stock is down 19.8% since reporting and currently trades at $64.78.

Read our full, actionable report on PVH here, it’s free.

Under Armour (NYSE:UAA)

Founded in 1996 by a former University of Maryland football player, Under Armour (NYSE:UAA) is an apparel brand specializing in sportswear designed to improve athletic performance.

Under Armour reported revenues of $1.18 billion, down 11.4% year on year. This print topped analysts’ expectations by 1.3%. It was a strong quarter as it also logged EPS guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EBITDA estimates.

Under Armour had the slowest revenue growth among its peers. The stock is up 5.2% since reporting and currently trades at $6.54.

Read our full, actionable report on Under Armour here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.