Medical device company DexCom (NASDAQ:DXCM) announced better-than-expected revenue in Q1 CY2025, with sales up 12.5% year on year to $1.04 billion. The company expects the full year’s revenue to be around $4.6 billion, close to analysts’ estimates. Its non-GAAP profit of $0.32 per share was in line with analysts’ consensus estimates.

Is now the time to buy DexCom? Find out by accessing our full research report, it’s free.

DexCom (DXCM) Q1 CY2025 Highlights:

- Revenue: $1.04 billion vs analyst estimates of $1.02 billion (12.5% year-on-year growth, 1.8% beat)

- Adjusted EPS: $0.32 vs analyst estimates of $0.33 (in line)

- Adjusted EBITDA: $230.4 million vs analyst estimates of $251.9 million (22.2% margin, 8.5% miss)

- The company reconfirmed its revenue guidance for the full year of $4.6 billion at the midpoint

- Operating Margin: 12.9%, up from 11% in the same quarter last year

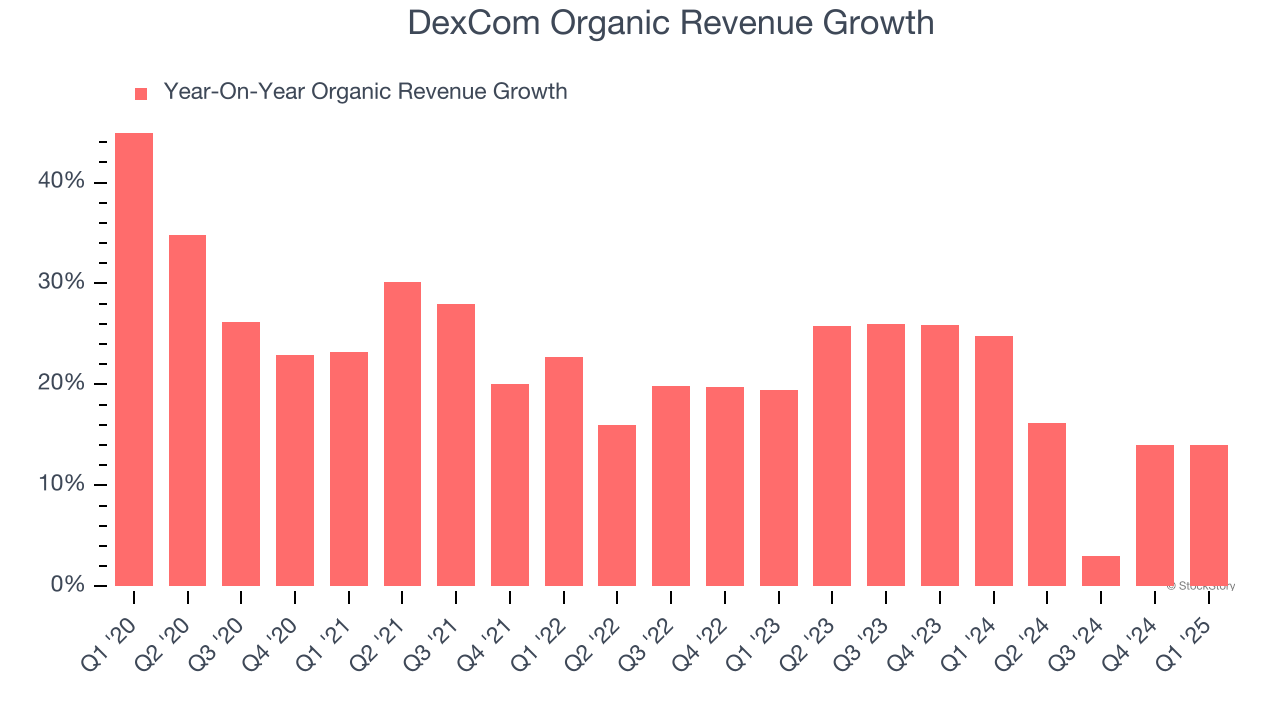

- Organic Revenue rose 14% year on year (24.8% in the same quarter last year)

- Market Capitalization: $27.99 billion

Company Overview

Founded in 1999 and receiving its first FDA approval in 2006, DexCom (NASDAQ:DXCM) develops and sells continuous glucose monitoring systems that allow people with diabetes to track their blood sugar levels without repeated finger pricks.

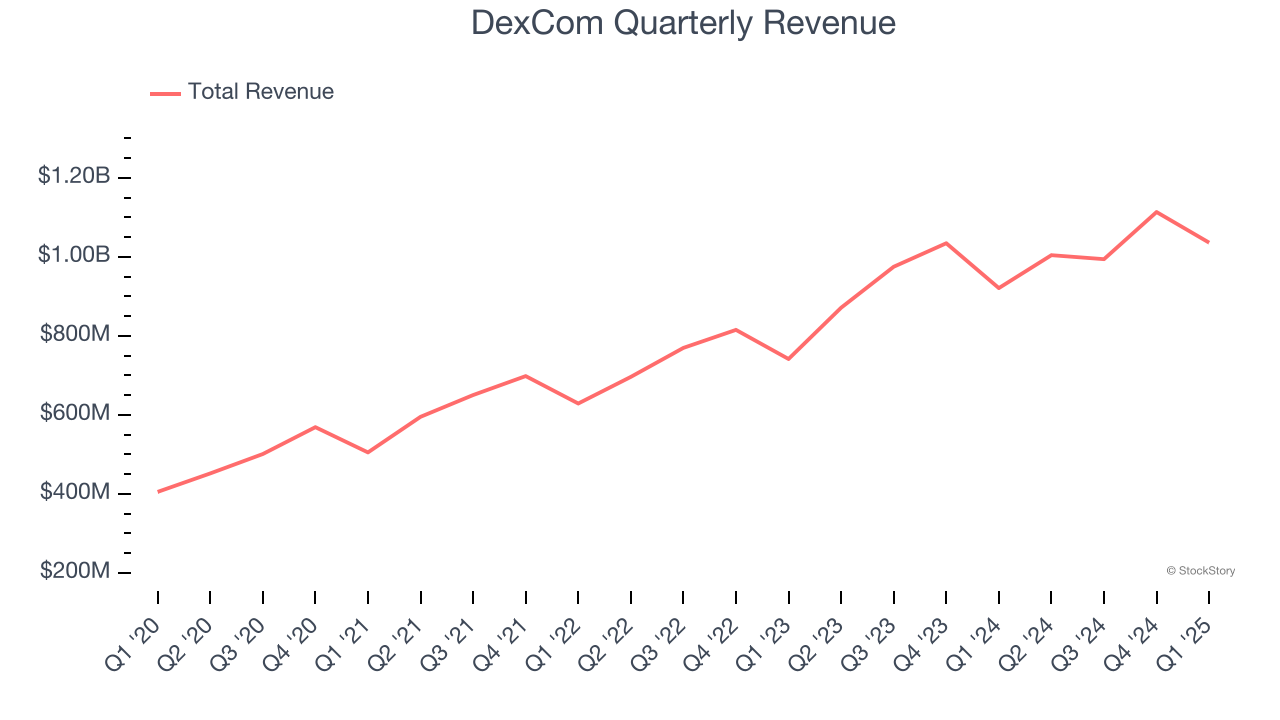

Sales Growth

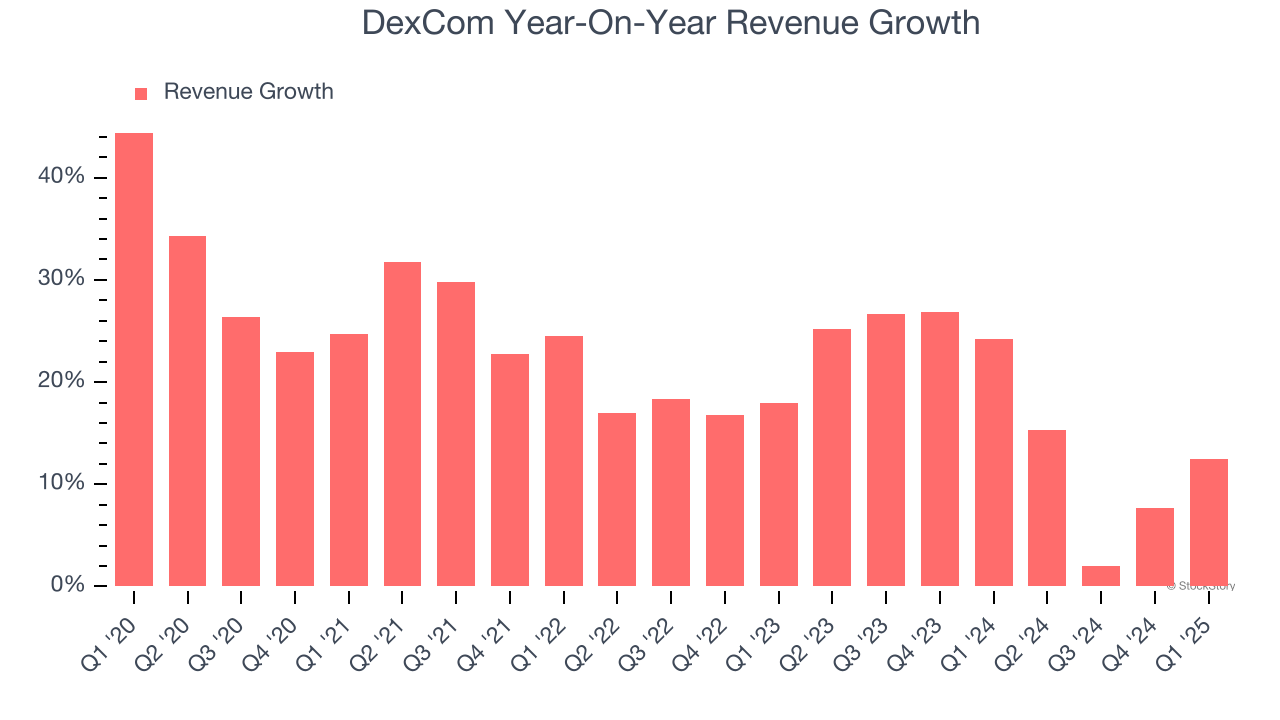

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, DexCom’s 21% annualized revenue growth over the last five years was impressive. Its growth surpassed the average healthcare company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. DexCom’s annualized revenue growth of 17.1% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

DexCom also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, DexCom’s organic revenue averaged 18.7% year-on-year growth. Because this number is better than its normal revenue growth, we can see that some mixture of divestitures and foreign exchange rates dampened its headline results.

This quarter, DexCom reported year-on-year revenue growth of 12.5%, and its $1.04 billion of revenue exceeded Wall Street’s estimates by 1.8%.

Looking ahead, sell-side analysts expect revenue to grow 15.2% over the next 12 months, a slight deceleration versus the last two years. Despite the slowdown, this projection is noteworthy and indicates the market is forecasting success for its products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

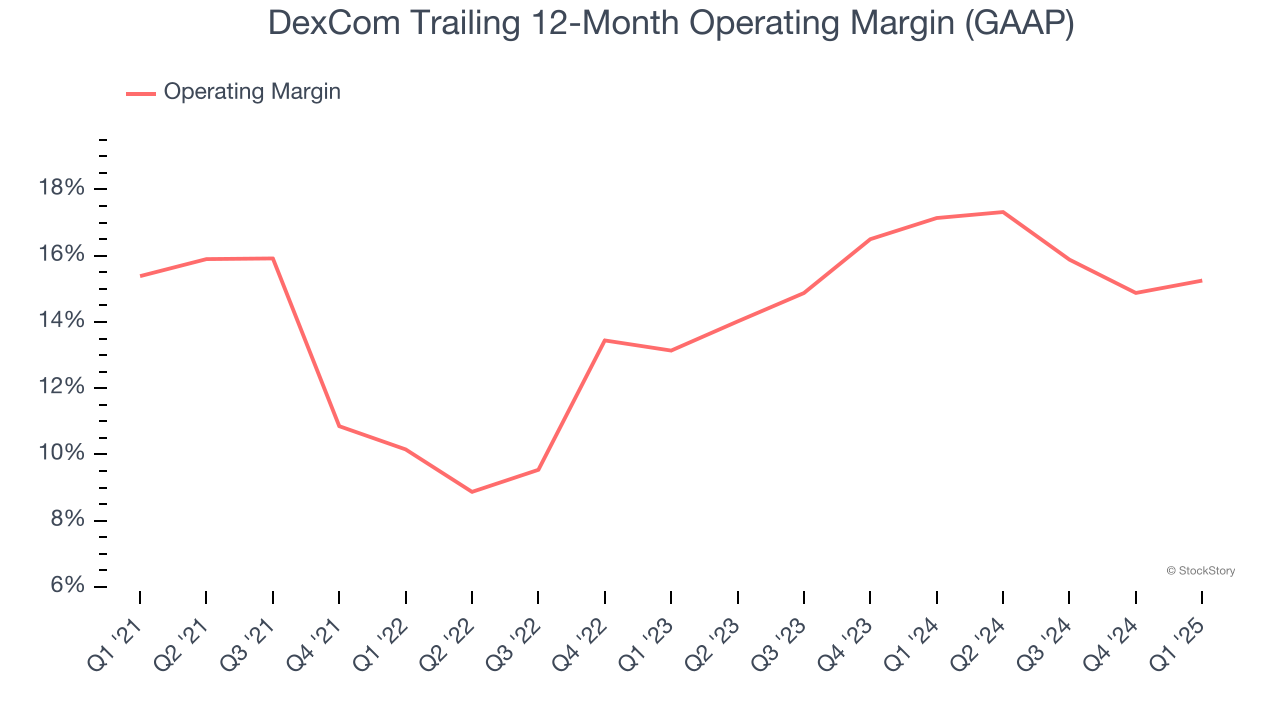

DexCom has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 14.5%, higher than the broader healthcare sector.

Analyzing the trend in its profitability, DexCom’s operating margin of 15.3% for the trailing 12 months may be around the same as five years ago, but it has increased by 2.1 percentage points over the last two years. This dynamic unfolded because its sales growth gave it operating leverage and shows it has some momentum on its side.

In Q1, DexCom generated an operating profit margin of 12.9%, up 1.9 percentage points year on year. This increase was a welcome development and shows it was more efficient.

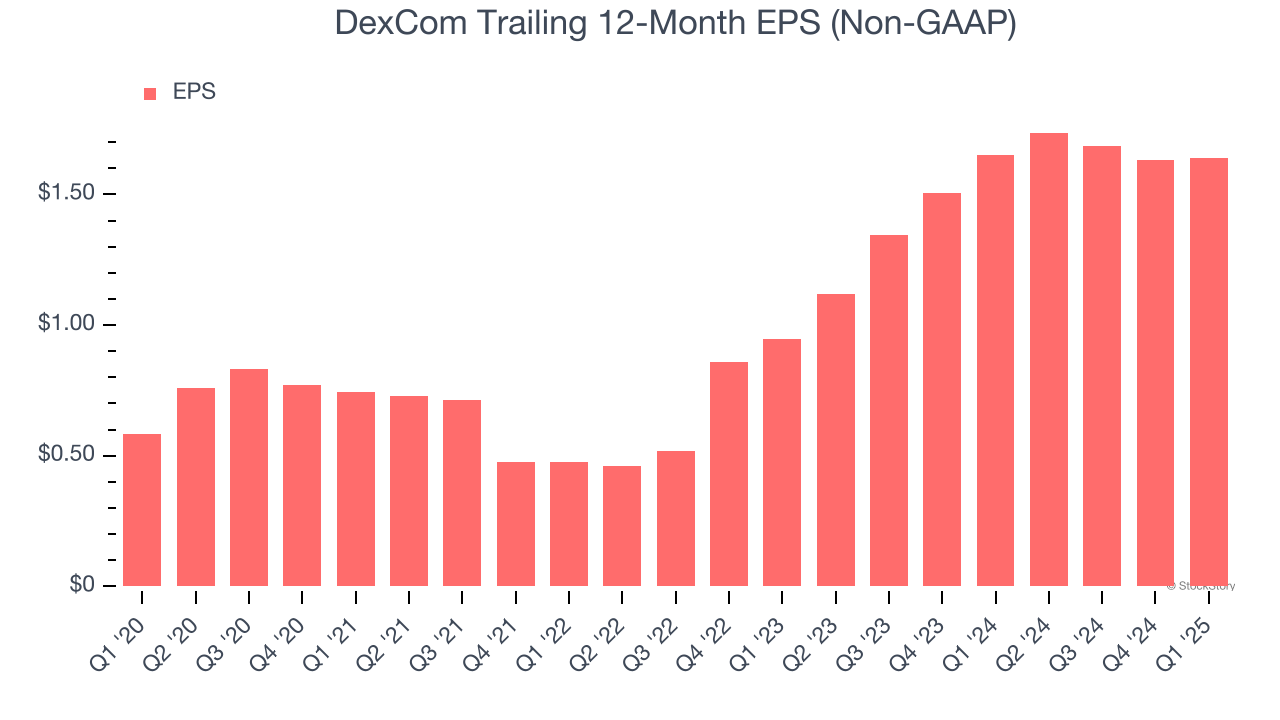

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

DexCom’s EPS grew at an astounding 23% compounded annual growth rate over the last five years, higher than its 21% annualized revenue growth. However, we take this with a grain of salt because its operating margin didn’t expand and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

In Q1, DexCom reported EPS at $0.32, in line with the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects DexCom’s full-year EPS of $1.64 to grow 30.7%.

Key Takeaways from DexCom’s Q1 Results

We were impressed by how significantly DexCom blew past analysts’ organic revenue expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its EPS missed. Overall, this print had some key positives. The stock traded up 4.1% to $73.13 immediately following the results.

Big picture, is DexCom a buy here and now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.