Parcel delivery company UPS (NYSE:UPS) reported Q1 CY2025 results topping the market’s revenue expectations, but sales were flat year on year at $21.5 billion. Its non-GAAP profit of $1.49 per share was 7.9% above analysts’ consensus estimates.

Is now the time to buy United Parcel Service? Find out by accessing our full research report, it’s free.

United Parcel Service (UPS) Q1 CY2025 Highlights:

- Revenue: $21.5 billion vs analyst estimates of $21.1 billion (flat year on year, 1.9% beat)

- Adjusted EPS: $1.49 vs analyst estimates of $1.38 (7.9% beat)

- "Given the current macro-economic uncertainty, the company is not providing any updates to its previously issued consolidated full-year outlook. "

- Operating Margin: 7.7%, in line with the same quarter last year

- Free Cash Flow Margin: 6.9%, down from 10.5% in the same quarter last year

- Market Capitalization: $82.29 billion

“I want to thank all UPSers for their hard work and efforts in this very dynamic environment,” said Carol Tomé, UPS chief executive officer.

Company Overview

Trademarking its recognizable UPS Brown color, UPS (NYSE:UPS) offers package delivery, supply chain management, and freight forwarding services.

Sales Growth

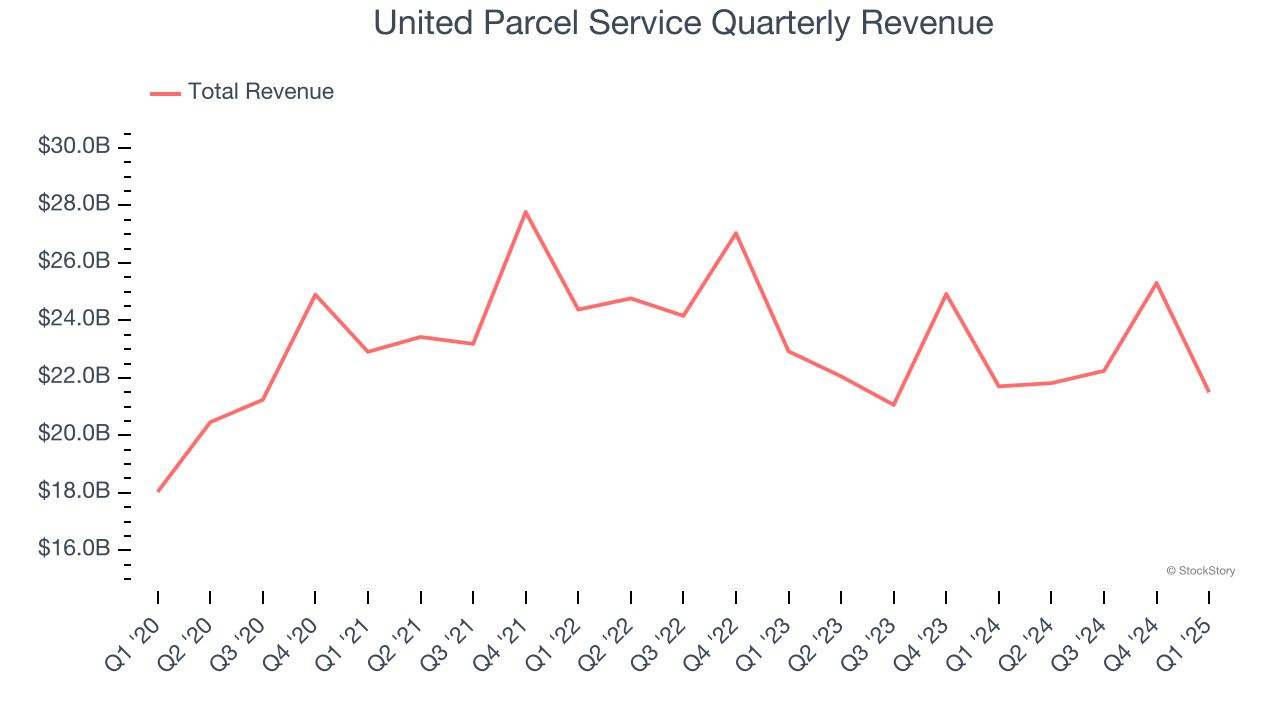

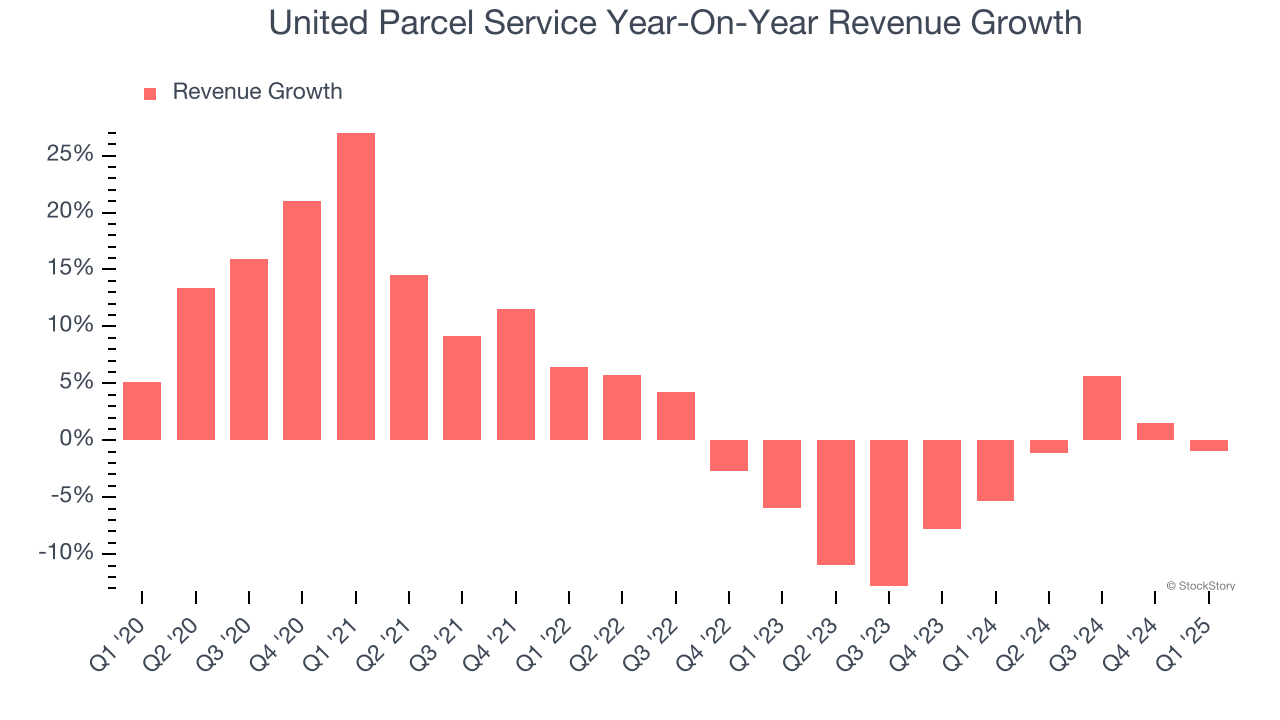

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, United Parcel Service’s 3.9% annualized revenue growth over the last five years was sluggish. This was below our standard for the industrials sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. United Parcel Service’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 4.1% annually. United Parcel Service isn’t alone in its struggles as the Air Freight and Logistics industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, United Parcel Service’s $21.5 billion of revenue was flat year on year but beat Wall Street’s estimates by 1.9%.

Looking ahead, sell-side analysts expect revenue to decline by 3.6% over the next 12 months, similar to its two-year rate. This projection is underwhelming and implies its newer products and services will not accelerate its top-line performance yet.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

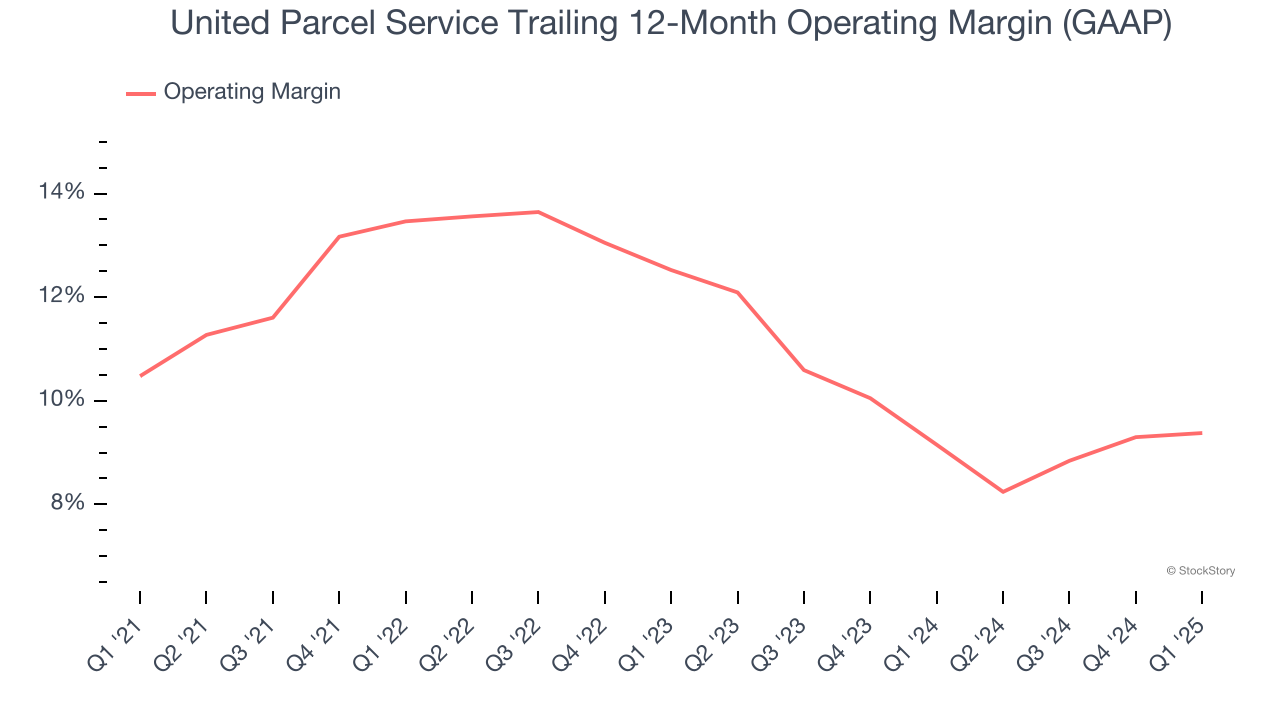

United Parcel Service has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 11.1%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, United Parcel Service’s operating margin decreased by 1.1 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, United Parcel Service generated an operating profit margin of 7.7%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

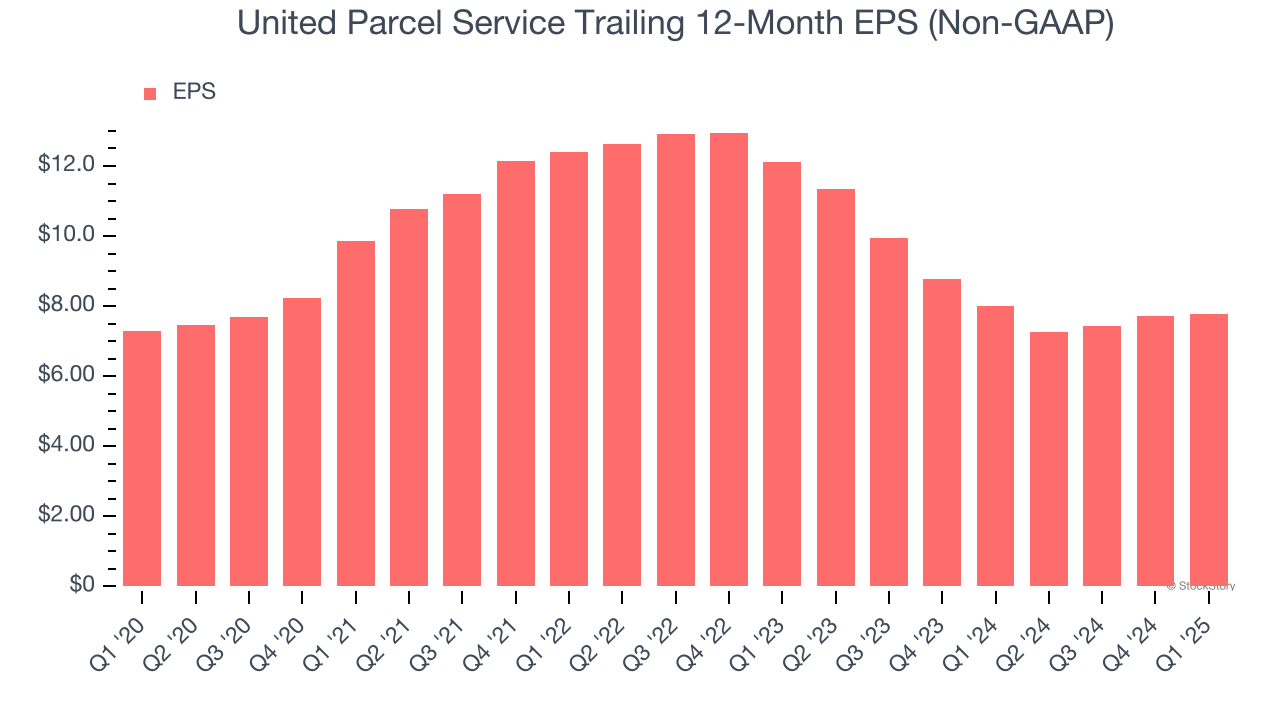

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

United Parcel Service’s EPS grew at a weak 1.3% compounded annual growth rate over the last five years, lower than its 3.9% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

We can take a deeper look into United Parcel Service’s earnings to better understand the drivers of its performance. As we mentioned earlier, United Parcel Service’s operating margin was flat this quarter but declined by 1.1 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

United Parcel Service’s two-year annual EPS declines of 19.8% were bad and lower than its two-year revenue performance.

In Q1, United Parcel Service reported EPS at $1.49, up from $1.43 in the same quarter last year. This print beat analysts’ estimates by 7.9%. Over the next 12 months, Wall Street expects United Parcel Service’s full-year EPS of $7.78 to shrink by 1.8%.

Key Takeaways from United Parcel Service’s Q1 Results

We enjoyed seeing United Parcel Service beat analysts’ revenue expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 4.3% to $101.30 immediately after reporting.

United Parcel Service put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.