Speciality material and gas containment company Luxfer (NYSE:LXFR) reported Q1 CY2025 results topping the market’s revenue expectations, with sales up 8.5% year on year to $97 million. Its non-GAAP profit of $0.23 per share was 35.3% above analysts’ consensus estimates.

Is now the time to buy Luxfer? Find out by accessing our full research report, it’s free.

Luxfer (LXFR) Q1 CY2025 Highlights:

- Revenue: $97 million vs analyst estimates of $86.7 million (8.5% year-on-year growth, 11.9% beat)

- Adjusted EPS: $0.23 vs analyst estimates of $0.17 (35.3% beat)

- Adjusted EBITDA: $11.3 million vs analyst estimates of $9.5 million (11.6% margin, 18.9% beat)

- Management reiterated its full-year Adjusted EPS guidance of $1 at the midpoint

- EBITDA guidance for the full year is $50 million at the midpoint, above analyst estimates of $47.9 million

- Operating Margin: 7.8%, up from 6.6% in the same quarter last year

- Free Cash Flow Margin: 4.3%, up from 2.6% in the same quarter last year

- Market Capitalization: $266.6 million

Company Overview

With its magnesium alloys used in the construction of the famous Spirit of St. Louis aircraft, Luxfer (NYSE:LXFR) offers specialized materials, components, and gas containment devices to various industries.

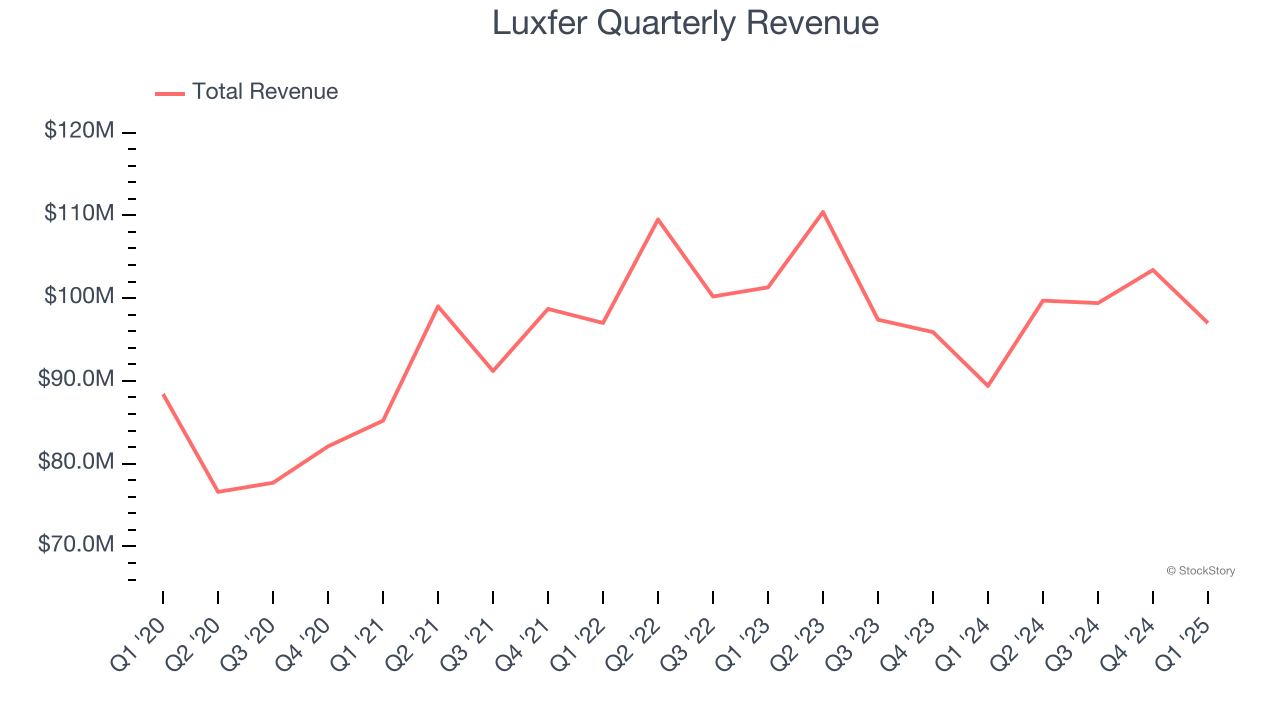

Sales Growth

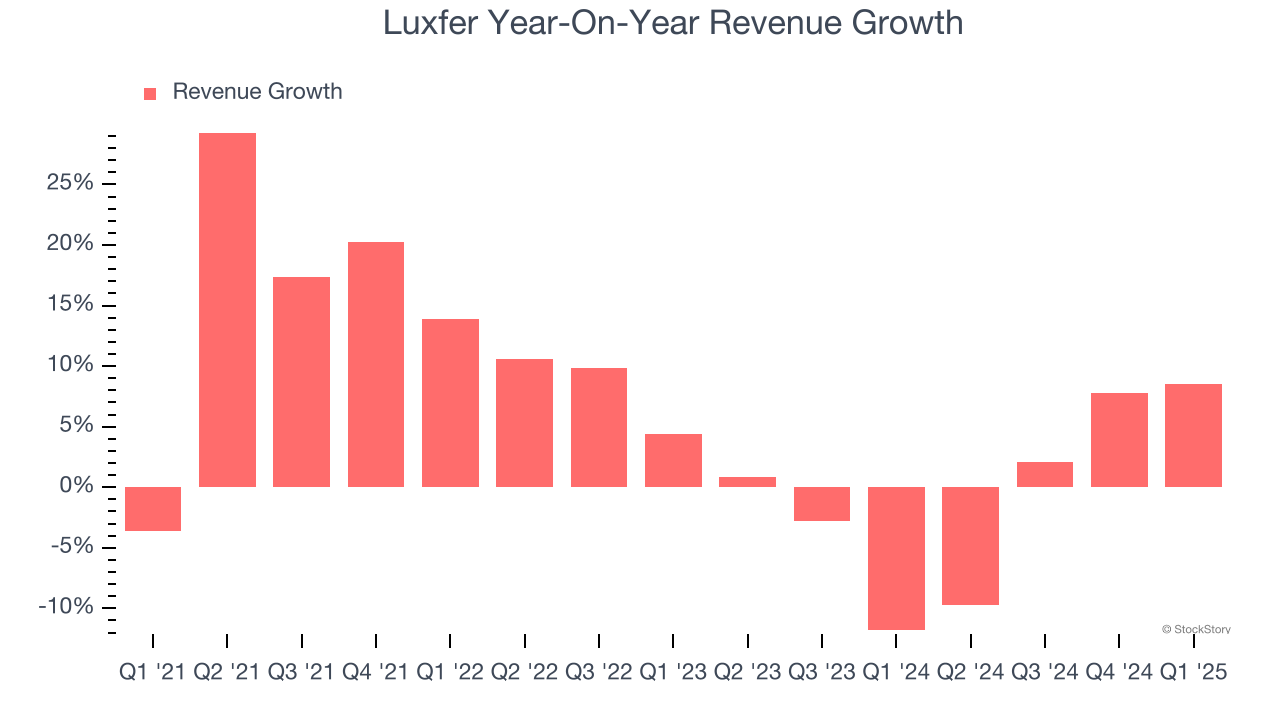

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Luxfer’s 5.6% annualized revenue growth over the last four years was tepid. This fell short of our benchmark for the industrials sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. Luxfer’s recent performance shows its demand has slowed as its annualized revenue growth of 1.6% over the last one years was below its four-year trend.

This quarter, Luxfer reported year-on-year revenue growth of 8.5%, and its $97 million of revenue exceeded Wall Street’s estimates by 11.9%.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

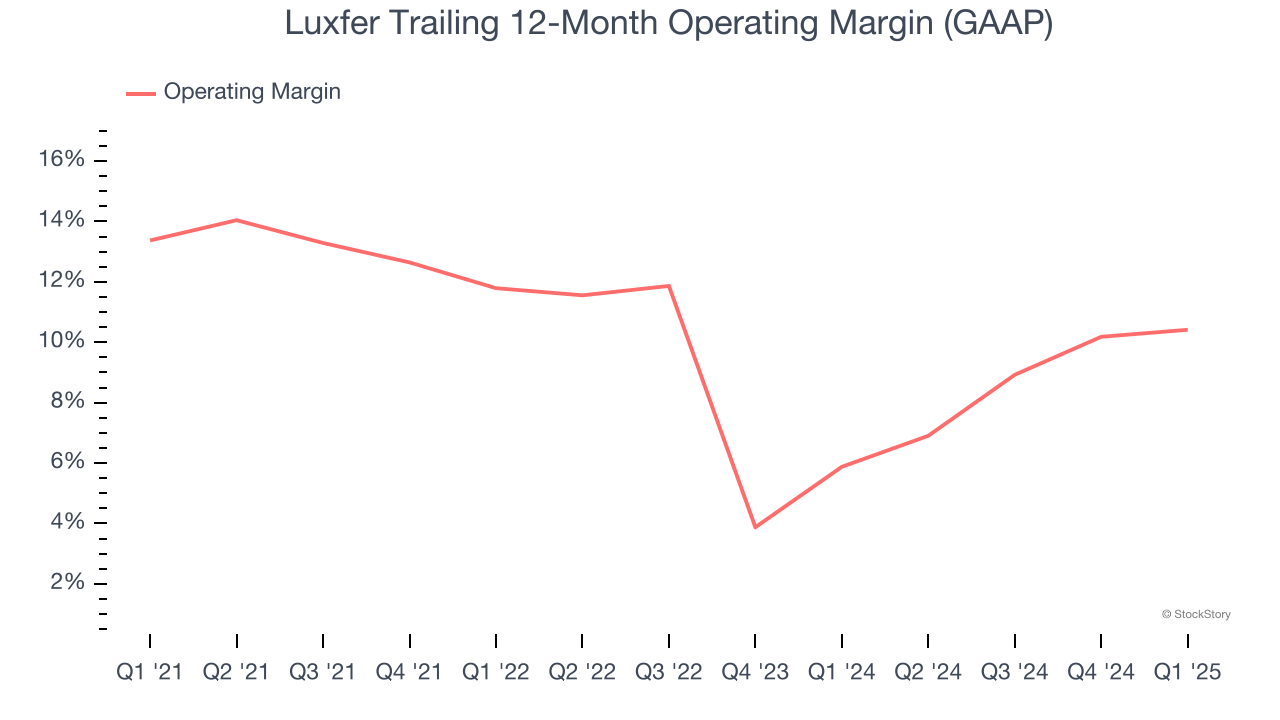

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Luxfer has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 9.8%, higher than the broader industrials sector.

Analyzing the trend in its profitability, Luxfer’s operating margin decreased by 3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Luxfer generated an operating profit margin of 7.8%, up 1.2 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

Earnings Per Share

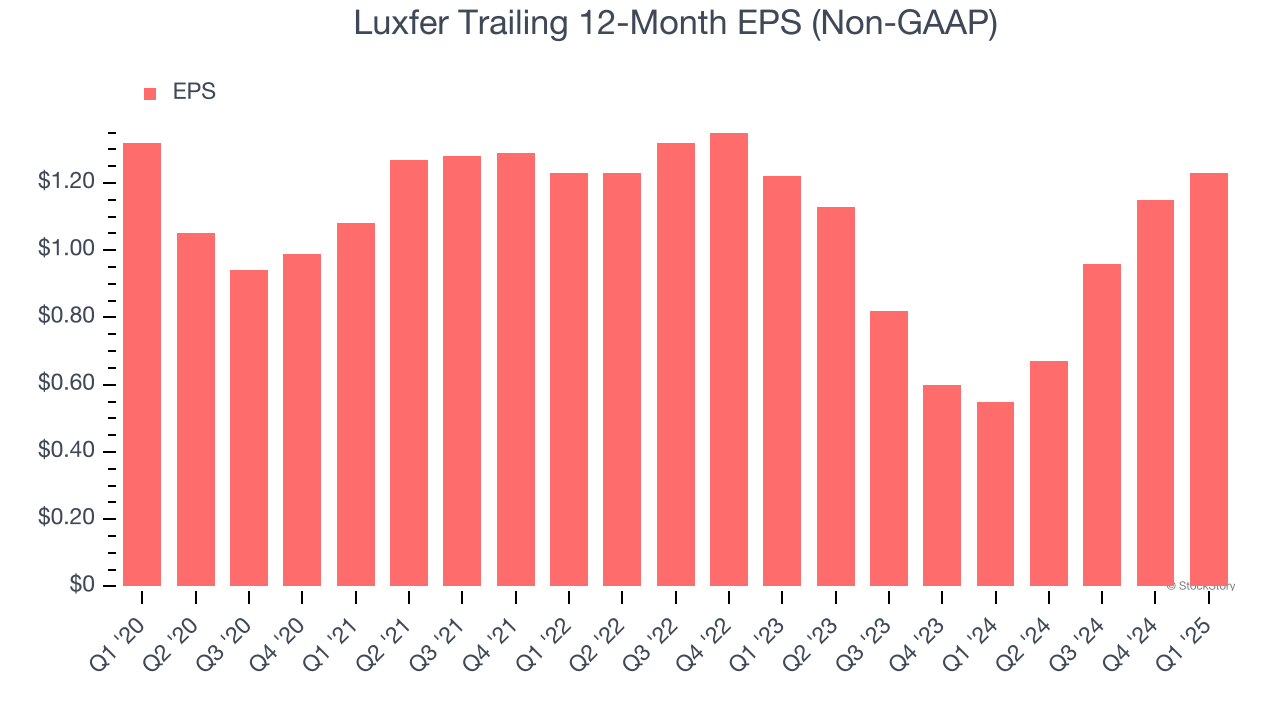

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Luxfer’s full-year EPS dropped 7.2%, or 1.4% annually, over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Luxfer’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Luxfer, EPS didn’t budge over the last two years, but at least that was better than its five-year trend. We hope its earnings can grow in the coming years.

In Q1, Luxfer reported EPS at $0.23, up from $0.15 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Luxfer’s full-year EPS of $1.23 to shrink by 14.6%.

Key Takeaways from Luxfer’s Q1 Results

We were impressed by how significantly Luxfer blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid quarter. The stock remained flat at $10 immediately following the results.

Indeed, Luxfer had a rock-solid quarterly earnings result, but is this stock a good investment here? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.