Wrapping up Q4 earnings, we look at the numbers and key takeaways for the healthcare technology for providers stocks, including Astrana Health (NASDAQ:ASTH) and its peers.

The healthcare technology industry focuses on delivering software, data analytics, and workflow solutions to hospitals, clinics, and other care facilities. These companies enable providers to streamline operations, optimize patient outcomes, and transition to value-based care models. They boast subscription-based revenues or long-term contracts, providing financial stability and growth potential. However, they face challenges such as lengthy sales cycles, significant upfront investment in technology development, and reliance on providers’ adoption of new tools, which can be hindered by budget constraints or resistance to change. Over the next few years, the sector is poised for growth as providers increasingly prioritize digital transformation and efficiency in response to rising healthcare costs and patient demand for seamless care. Tailwinds include the growing adoption of AI-driven tools for patient engagement and operational improvements, government incentives for digitization, and the expansion of telehealth and remote patient monitoring. However, headwinds such as tightening hospital budgets, cybersecurity threats, and the fragmented nature of healthcare systems could slow adoption.

The 6 healthcare technology for providers stocks we track reported a slower Q4. As a group, revenues beat analysts’ consensus estimates by 3.1% while next quarter’s revenue guidance was 0.6% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 11.1% since the latest earnings results.

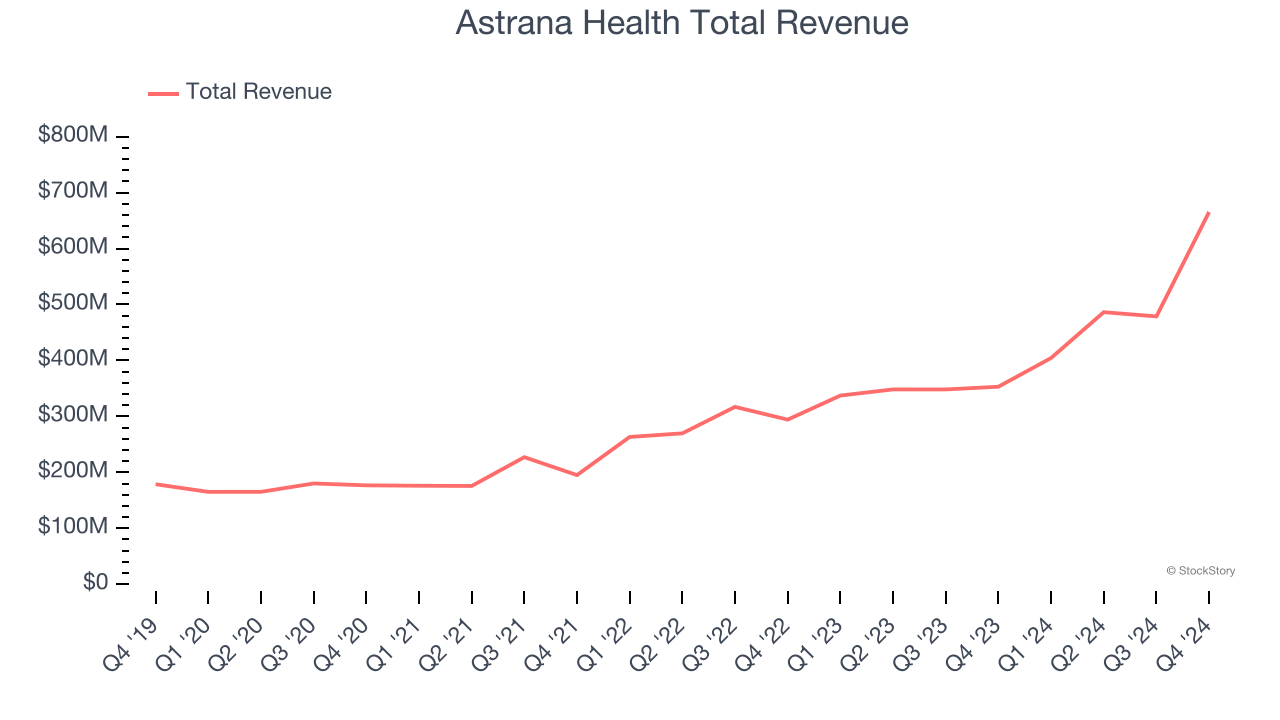

Astrana Health (NASDAQ:ASTH)

Formerly known as Apollo Medical Holdings until early 2024, Astrana Health (NASDAQ:ASTH) operates a technology-powered healthcare platform that enables physicians to deliver coordinated care while successfully participating in value-based payment models.

Astrana Health reported revenues of $665.2 million, up 88.4% year on year. This print exceeded analysts’ expectations by 6.9%. Despite the top-line beat, it was still a mixed quarter for the company with full-year revenue guidance beating analysts’ expectations.

Astrana Health pulled off the fastest revenue growth and highest full-year guidance raise of the whole group. Still, the market seems discontent with the results. The stock is down 0.9% since reporting and currently trades at $34.17.

Is now the time to buy Astrana Health? Access our full analysis of the earnings results here, it’s free.

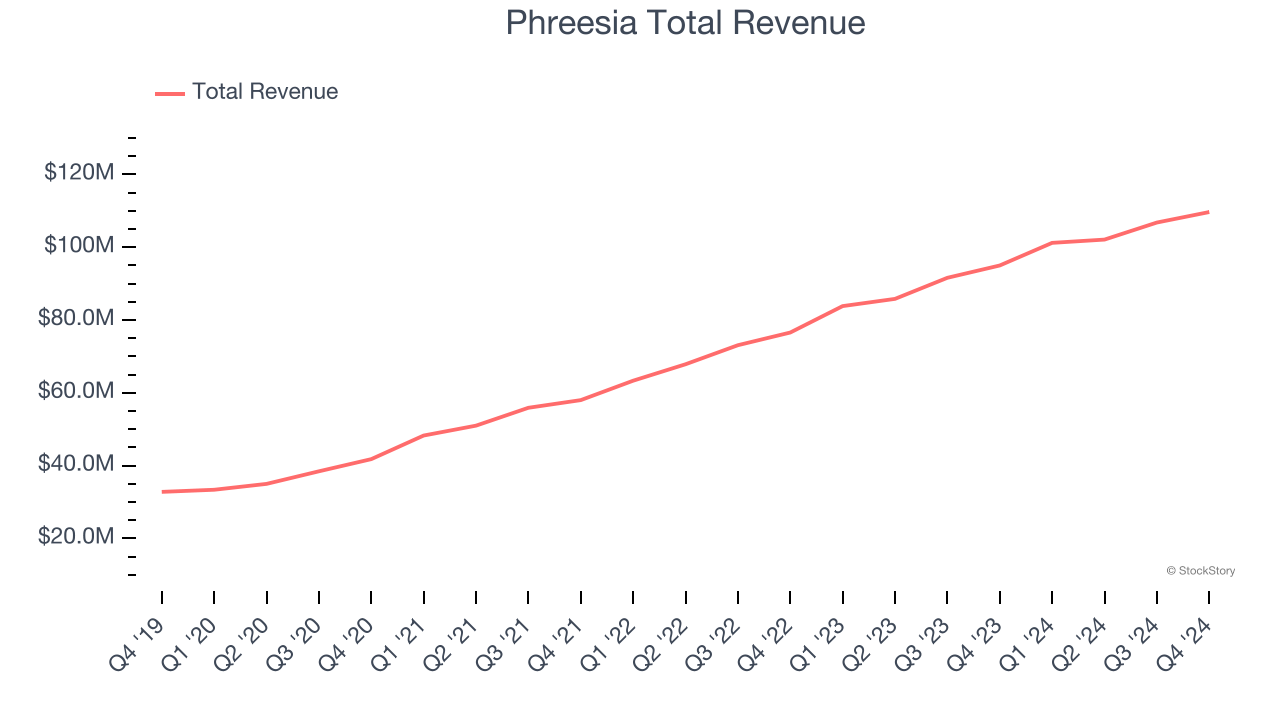

Best Q4: Phreesia (NYSE:PHR)

Founded in 2005 to streamline the traditionally paper-heavy patient check-in process, Phreesia (NYSE:PHR) provides software solutions that automate patient intake, registration, and payment processes for healthcare organizations while improving patient engagement in their care.

Phreesia reported revenues of $109.7 million, up 15.4% year on year, outperforming analysts’ expectations by 0.7%. The business had a strong quarter with a solid beat of analysts’ EPS estimates and full-year EBITDA guidance topping analysts’ expectations.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $23.67.

Is now the time to buy Phreesia? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Evolent Health (NYSE:EVH)

Founded in 2011 to transform how healthcare is delivered to patients with complex needs, Evolent Health (NYSE:EVH) provides specialty care management services and technology solutions that help health plans and providers deliver better care for patients with complex conditions.

Evolent Health reported revenues of $646.5 million, up 16.3% year on year, falling short of analysts’ expectations by 0.7%. It was a softer quarter as it posted a significant miss of analysts’ EPS estimates and EBITDA guidance for next quarter missing analysts’ expectations significantly.

Evolent Health delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. As expected, the stock is down 15.9% since the results and currently trades at $9.02.

Read our full analysis of Evolent Health’s results here.

Privia Health (NASDAQ:PRVA)

Operating in 13 states and the District of Columbia with over 4,300 providers serving more than 4.8 million patients, Privia Health (NASDAQ:PRVA) is a technology-driven company that helps physicians optimize their practices, improve patient experiences, and transition to value-based care models.

Privia Health reported revenues of $460.9 million, up 4.6% year on year. This result surpassed analysts’ expectations by 9.4%. More broadly, it was a satisfactory quarter as it also produced a solid beat of analysts’ sales volume estimates but full-year revenue guidance missing analysts’ expectations.

Privia Health delivered the biggest analyst estimates beat among its peers. The stock is down 1.2% since reporting and currently trades at $23.76.

Read our full, actionable report on Privia Health here, it’s free.

Premier (NASDAQ:PINC)

Operating one of the largest healthcare group purchasing organizations in the United States with over 4,350 hospital members, Premier (NASDAQ:PINC) is a technology-driven healthcare improvement company that helps hospitals, health systems, and other providers reduce costs and improve clinical outcomes.

Premier reported revenues of $240.3 million, down 14.2% year on year. This number met analysts’ expectations. Aside from that, it was a slower quarter as it logged a significant miss of analysts’ EPS estimates and full-year revenue guidance missing analysts’ expectations.

Premier had the slowest revenue growth among its peers. The stock is down 15.2% since reporting and currently trades at $19.01.

Read our full, actionable report on Premier here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.