Young adult apparel retailer American Eagle Outfitters (NYSE:AEO) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 5.7% year on year to $1.36 billion. Its GAAP profit of $0.53 per share was 24% above analysts’ consensus estimates.

Is now the time to buy American Eagle? Find out by accessing our full research report, it’s free for active Edge members.

American Eagle (AEO) Q3 CY2025 Highlights:

- Revenue: $1.36 billion vs analyst estimates of $1.32 billion (5.7% year-on-year growth, 3.1% beat)

- EPS (GAAP): $0.53 vs analyst estimates of $0.43 (24% beat)

- Adjusted EBITDA: $165.5 million vs analyst estimates of $154.1 million (12.1% margin, 7.4% beat)

- Operating Margin: 8.3%, in line with the same quarter last year

- Locations: 1,190 at quarter end, up from 1,186 in the same quarter last year

- Same-Store Sales rose 4% year on year (3% in the same quarter last year)

- Market Capitalization: $3.60 billion

“I’m extremely pleased with the significant trend change across our business reflecting decisive steps taken from merchandising to marketing to operations—all having a positive impact. Record third quarter revenue was highlighted by Aerie’s double-digit comparable sales increase and positive growth at American Eagle, contributing to results that exceeded expectations,” commented Jay Schottenstein, Executive Chairman of the Board and Chief Executive Officer, AEO Inc.

Company Overview

With a heavy focus on denim, American Eagle Outfitters (NYSE:AEO) is a specialty retailer offering an assortment of apparel and accessories to young adults.

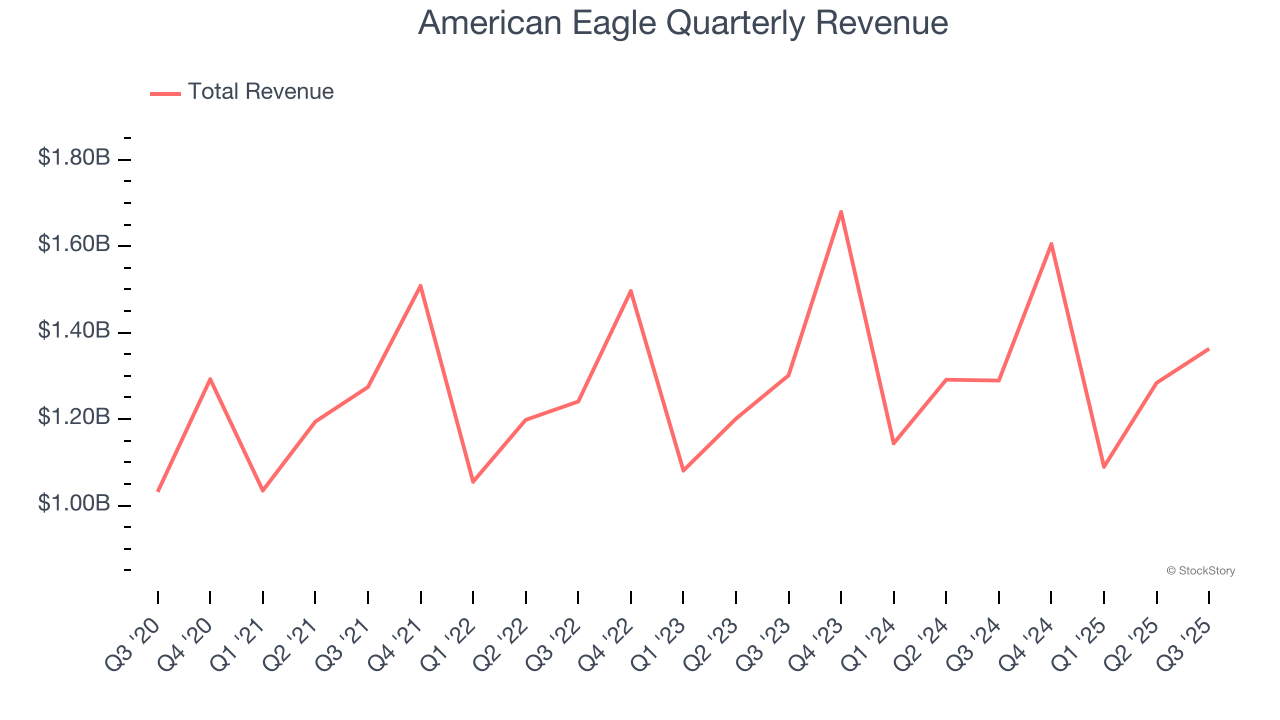

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $5.34 billion in revenue over the past 12 months, American Eagle is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

As you can see below, American Eagle grew its sales at a sluggish 2.2% compounded annual growth rate over the last three years (we compare to 2019 to normalize for COVID-19 impacts) as its store footprint remained unchanged.

This quarter, American Eagle reported year-on-year revenue growth of 5.7%, and its $1.36 billion of revenue exceeded Wall Street’s estimates by 3.1%.

Looking ahead, sell-side analysts expect revenue to grow 1.5% over the next 12 months, similar to its three-year rate. This projection is underwhelming and indicates its newer products will not catalyze better top-line performance yet.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Store Performance

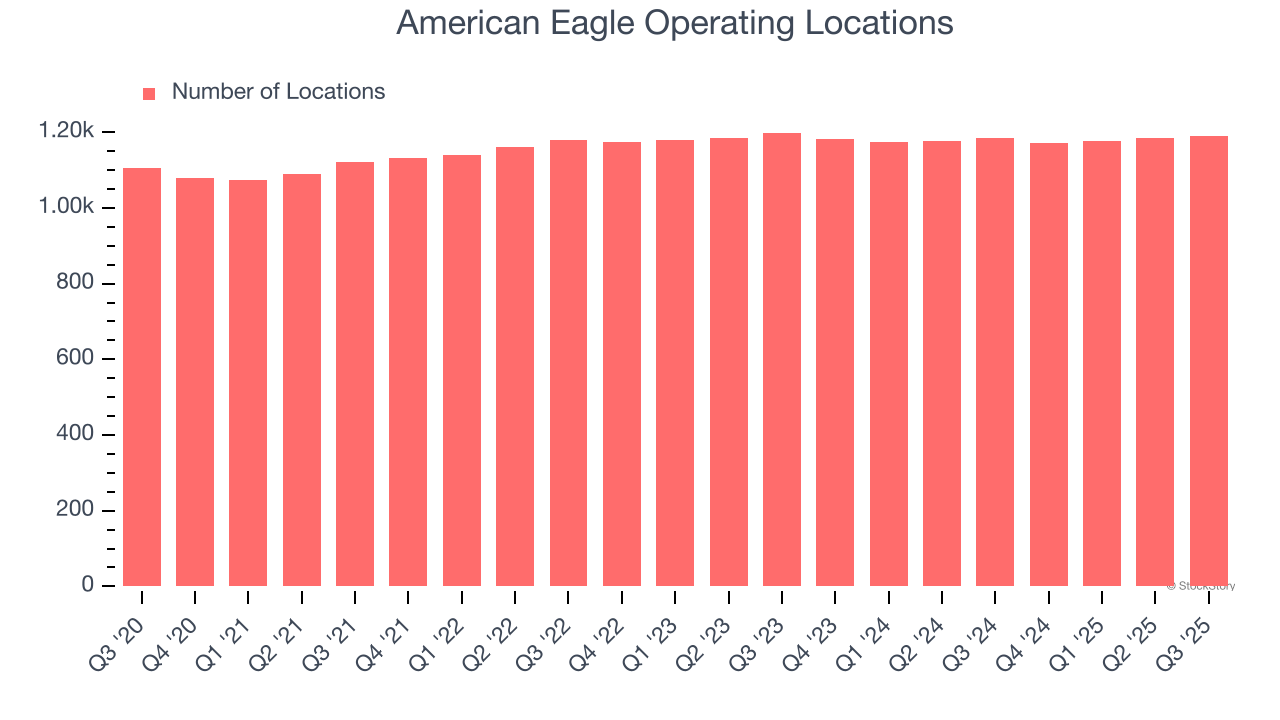

Number of Stores

A retailer’s store count often determines how much revenue it can generate.

American Eagle listed 1,190 locations in the latest quarter and has kept its store count flat over the last two years while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

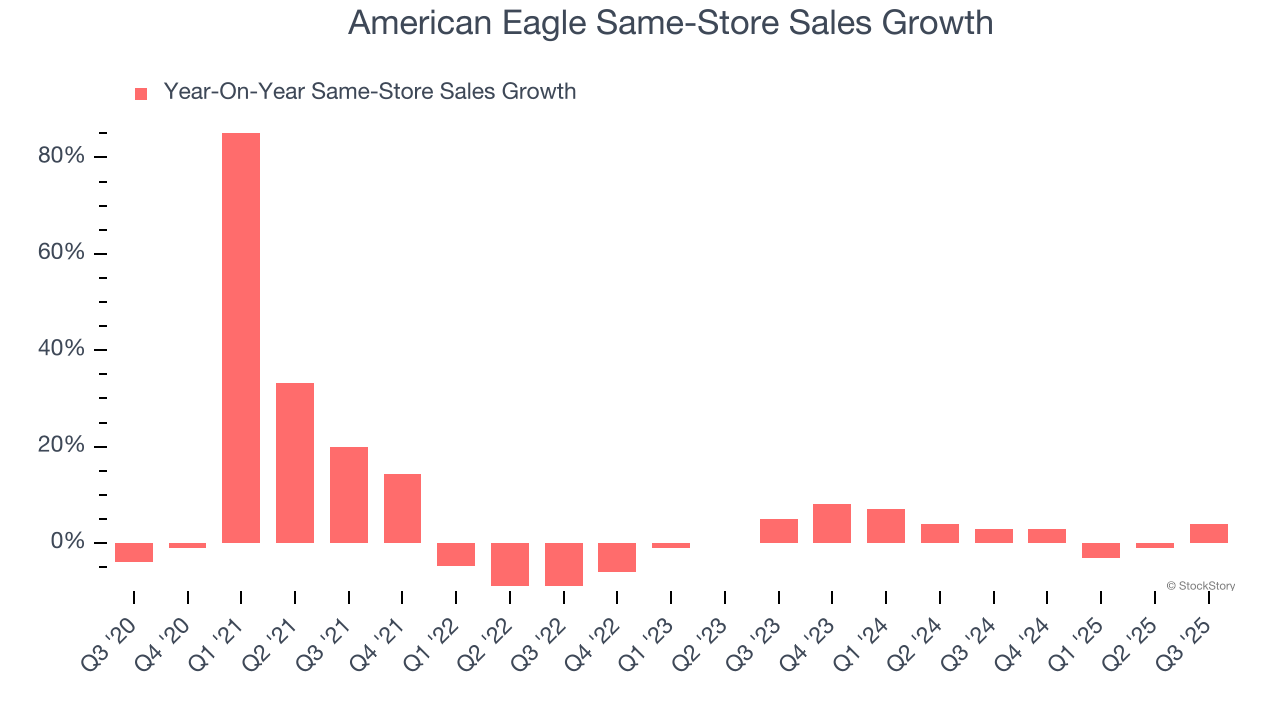

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

American Eagle’s demand has been healthy for a retailer over the last two years. On average, the company has grown its same-store sales by a robust 3.1% per year. Given its flat store base over the same period, this performance stems from not only increased foot traffic at existing locations but also higher e-commerce sales as demand shifts from in-store to online.

In the latest quarter, American Eagle’s same-store sales rose 4% year on year. This performance was more or less in line with its historical levels.

Key Takeaways from American Eagle’s Q3 Results

We enjoyed seeing American Eagle beat analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 9.3% to $22.98 immediately following the results.

Sure, American Eagle had a solid quarter, but if we look at the bigger picture, is this stock a buy? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.