Coffeehouse chain Starbucks (NASDAQ:SBUX) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 5.5% year on year to $9.57 billion. Its non-GAAP profit of $0.52 per share was 6% below analysts’ consensus estimates.

Is now the time to buy Starbucks? Find out by accessing our full research report, it’s free for active Edge members.

Starbucks (SBUX) Q3 CY2025 Highlights:

- Revenue: $9.57 billion vs analyst estimates of $9.33 billion (5.5% year-on-year growth, 2.6% beat)

- Adjusted EPS: $0.52 vs analyst expectations of $0.55 (6% miss)

- Operating Margin: 2.9%, down from 14.4% in the same quarter last year

- Locations: 18,311 at quarter end, down from 40,199 in the same quarter last year

- Same-Store Sales rose 1% year on year (-7% in the same quarter last year)

- Market Capitalization: $97.11 billion

Company Overview

Started by three friends in Seattle’s historic Pike Place Market, Starbucks (NASDAQ:SBUX) is a globally-renowned coffeehouse chain that offers a wide selection of high-quality coffee, beverages, and food items.

Revenue Growth

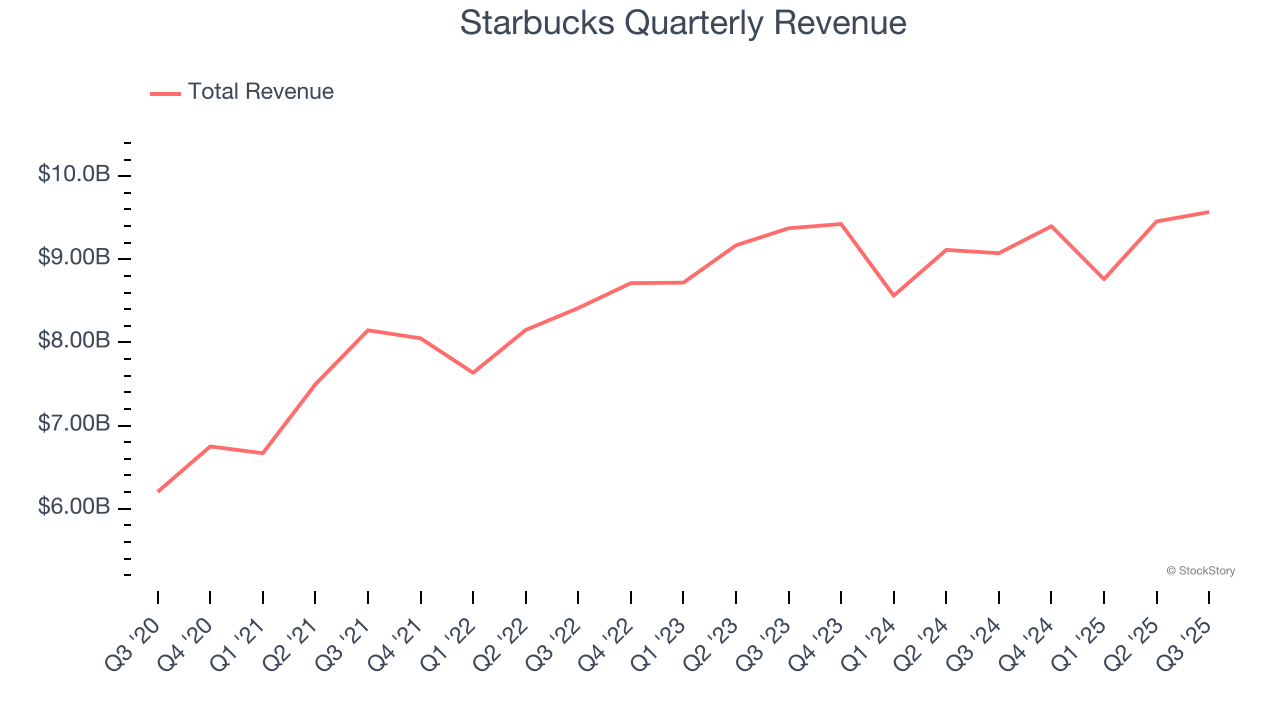

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $37.18 billion in revenue over the past 12 months, Starbucks is one of the most widely recognized restaurant chains and benefits from customer loyalty, a luxury many don’t have. Its scale also gives it negotiating leverage with suppliers, enabling it to source its ingredients at a lower cost. However, its scale is a double-edged sword because there are only a finite of number places to build restaurants, making it harder to find incremental growth. To expand meaningfully, Starbucks likely needs to tweak its prices, start new chains, or enter new markets.

As you can see below, Starbucks’s 5.8% annualized revenue growth over the last six years (we compare to 2019 to normalize for COVID-19 impacts) was tepid as it closed restaurants.

This quarter, Starbucks reported year-on-year revenue growth of 5.5%, and its $9.57 billion of revenue exceeded Wall Street’s estimates by 2.6%.

Looking ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months, a slight deceleration versus the last six years. This projection is underwhelming and implies its menu offerings will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Restaurant Performance

Number of Restaurants

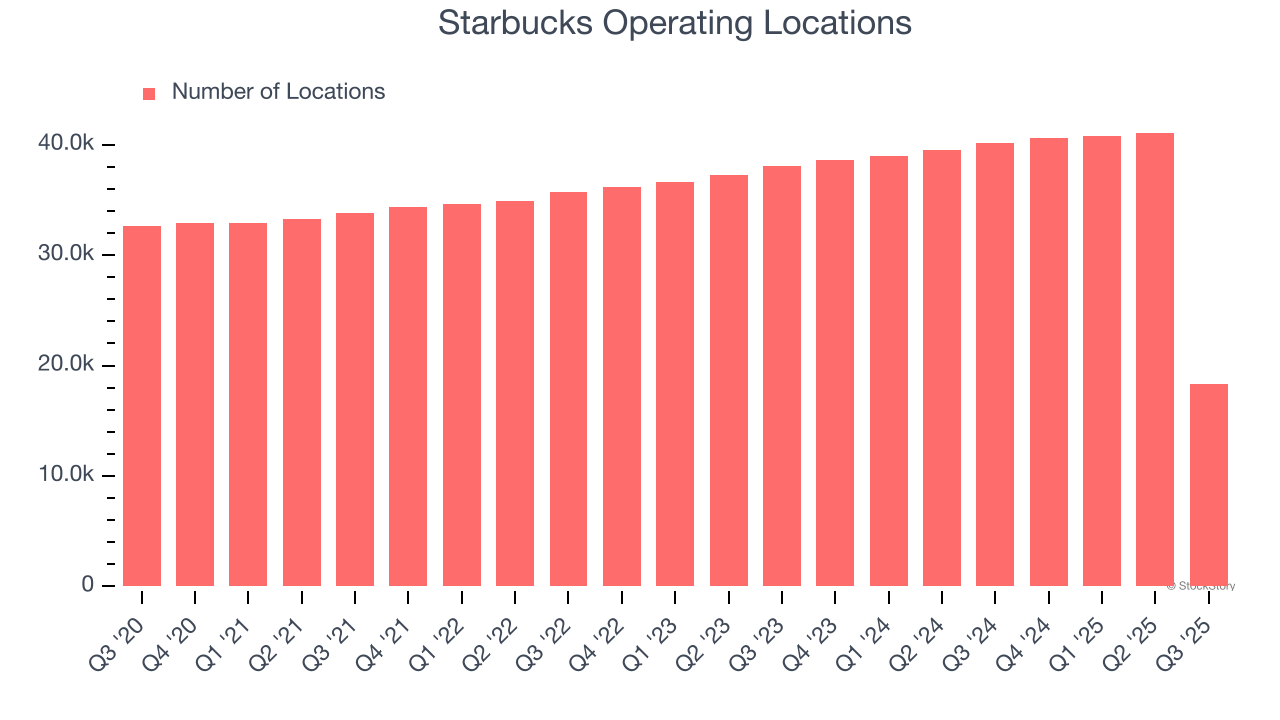

A restaurant chain’s total number of dining locations influences how much it can sell and how quickly revenue can grow.

Starbucks listed 18,311 locations in the latest quarter and has generally closed its restaurants over the last two years, averaging 2% annual declines.

When a chain shutters restaurants, it usually means demand for its meals is waning, and it is responding by closing underperforming locations to improve profitability.

Same-Store Sales

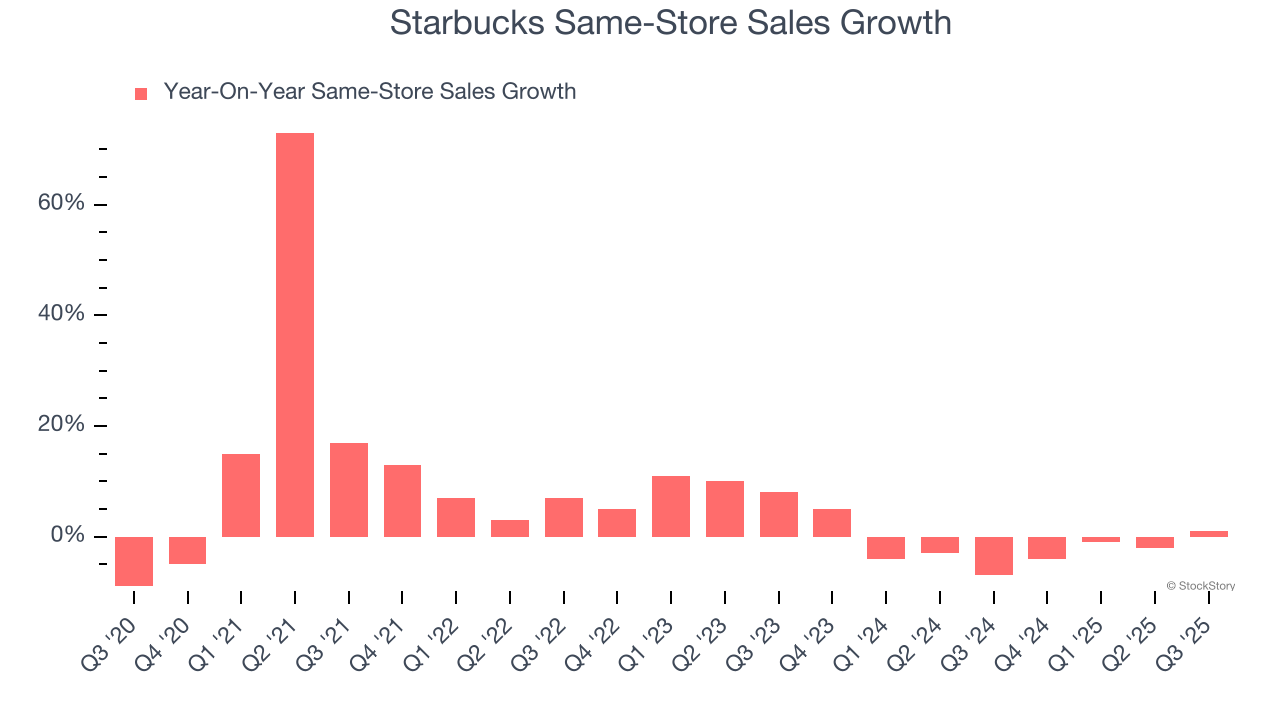

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth at restaurants open for at least a year.

Starbucks’s demand has been shrinking over the last two years as its same-store sales have averaged 1.9% annual declines. This performance isn’t ideal, and Starbucks is attempting to boost same-store sales by closing restaurants (fewer locations sometimes lead to higher same-store sales).

In the latest quarter, Starbucks’s same-store sales rose 1% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

Key Takeaways from Starbucks’s Q3 Results

We enjoyed seeing Starbucks beat analysts’ revenue expectations this quarter. We were also glad its same-store sales outperformed Wall Street’s estimates. This was the first positive growth in roughly two years, which is something the market will cheer. On the other hand, its EPS fell short of Wall Street’s estimates. Overall, this print was mixed. The stock traded up 2.2% to $85.98 immediately following the results.

Big picture, is Starbucks a buy here and now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.